Welcome, PwC PartnersFidelity is dedicated to your financial wellness, offering a wide range of educational resources and professional guidance to help you take control of your future.

|

Benefits for PwC Partners

If you are a PwC Partner, Manager or have certain internal PwC restrictions, you may want to consider a Fidelity Cash Management Account (FCMA). Benefits include:

- FDIC insurance: Coverage up to $1,250,000—5 times more than the typical bank‡

- Ability to purchase mutual funds, ETFs and individual securities

- No options or margin availability

- No managed account purchases (if you are approved for discretionary accounts, please open the appropriate account or call 1.800.726.0286)

- FCMA transactions are available for reporting on BSP

A Fidelity® Cash Management Account—all the features you need from a traditional checking account, without the bank fees.§ Learn more.

§ The Fidelity Cash Management Account is a brokerage account designed for investing, spending and cash management. Investing excludes options and margin trading. It is not intended to serve as your main account for For a more traditional brokerage account, consider the Fidelity Account.®

Fidelity Go®

A digital managed account designed for investors looking for simple, professional money management solutions.1

A digital financial service

With our robo advisor, answer a few questions and we'll build a strategy to meet your needs.

Professional management of your money

We monitor the markets and automatically rebalance the portfolio to keep you on track.

Affordable investing

No advisory fee for balances under $25,000, 0.35% advisory fee for balances of $25,000+

We know crypto

From bitcoin mining in 2014, to our first crypto service in 2018, we learned by doing.

Go direct or go broad

Trade bitcoin and ethereum directly5 or get broader access with ETFs—your choice.

Financial Planning with Fidelity

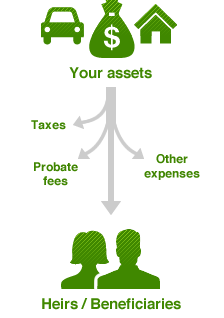

Our free, online service for Fidelity customers guides you through the estate planning process so you can work with an attorney to create a plan.

Create a free plan to see your current financial picture and how to make progress toward your short- and long-term goals.

Set goals, explore relevant options to save or invest, then link accounts directly to your goals.

Level up your investing skills by watching In the Money, a weekly live show where a Fidelity professional discusses the macro backdrop and new trade ideas with Tony Zhang of OptionsPlay. Hear original insights, options strategies, and timely trades tailored for the evolving market conditions.4

Level up your investing skills by watching In the Money, a weekly live show where a Fidelity professional discusses the macro backdrop and new trade ideas with Tony Zhang of OptionsPlay. Hear original insights, options strategies, and timely trades tailored for the evolving market conditions.4

When: Live every Thursday at 2 p.m. ET

![]()

Keeping your information and assets secure

The protection of your portfolio and personal information is the foundation of our relationship. That's why we offer the latest technology to help give you the ultimate benefit—peace of mind.

Find out what others are saying about us

Awards and recognition

See what independent third-party reviewers think of our products and services.

Financial wellness & education

Improve your financial wellness with these tools and resources

Financial wellness is comprehensive. When you're financially well, you feel confident about the future and know what you're going to do next with your money. From budgeting your finances and paying down debt to creating an emergency fund and investing for the future, it's all about learning what to do and then taking action. We update this Financial Wellness section every quarter, to make sure we provide you with timely information that meets your needs—so keep coming back.

The more skills and knowledge you gain, the more you'll be able to improve your financial wellness. Check out these tips and resources for staying on top of key money matters:

Fidelity Webcast hub:

Practical conversations to help you work toward living well financially, today and tomorrow:

Tax benefits of donor-advised funds

Discover a smarter way to give from Fidelity Charitable®. Learn how you can potentially maximize your charitable giving and increase your tax savings with a donor-advised fund.

Year-End Strategies for Charitable Giving

Consider these 8 tax-savvy ways to make your giving go further this year.

We're committed to your security

We safeguard your accounts with strong encryption, firewalls, secure email, and proactive 24/7 system surveillance.

Learn more about these important topics:

Fidelity for her

Learn about the unique financial considerations women face, when to save vs invest, and which accounts make sense for your goals.

Today's Financial News & Guidance

Comprehensive third-party articles from trusted news sources to help you make the best decisions for your money.

Fidelity Viewpoints®: Market Sense

Find out what's moving markets and get timely economic updates and market outlooks from Fidelity professionals.

Fidelity Viewpoints

![]()

Visit Fidelity Learn for other articles, videos, and webinars

With the Fidelity Youth® Account, your teen can:

- Start investing with as little as a $1.

- Enjoy no subscription fees, no account fees, and no minimum balances to open.

- Use their own debit card to spend from their Fidelity Youth Account.

Interested in learning about strategies and tools geared towards long-term investing success? Listen into Season 4 of Fresh Invest as we'll discuss the investing life cycle in the context of today's economic climate.

Your fees are on us

Call us at 800-726-0286 once you've opened your account to get up to $150 in account transfer fees reimbursed.2

Please note: As the employee, it's your responsibility to adhere to your firm's compliance policy and code of ethics. For more information, contact your compliance office.

Please also remember that Fidelity Cash Management and Health Savings accounts need to be disclosed to compliance.

We're here to help

Help is here 24/7. Call us, chat with an investment professional, or visit an Investor Center.

Online Support