Fidelity® Intermediate Municipal StrategyA separately managed account investing in investment-grade municipal bonds, which seeks to deliver interest income exempt from federal income taxes while balancing risk and return. This actively managed strategy looks to maintain an average target duration of 3 to 5 years. |

Investment strategy: Seeks to generate federally tax-exempt interest income, while working to limit risk to principal over a full market cycle.

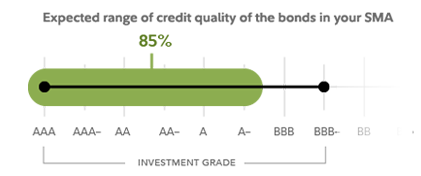

Types of investments: Primarily A− or higher investment-grade1 municipal bonds at time of purchase

Investment minimum: $350,0002

Gross annual advisory fee: 0.35% – 0.40%3 (varies based on total assets invested)

- Designed for investors seeking an actively managed portfolio of investment-grade bonds. This strategy provides the investment team the flexibility to sell bonds prior to maturity—aiming to enhance return potential while effectively managing risk.

- Managed by an investment team leveraging Fidelity's extensive fixed income resources and research capabilities.

- Aims to generate higher levels of federally tax-exempt interest income by allocating a portion of the account to lower credit quality investment grade4 bonds.

- Considers both income and price appreciation as potential sources of return and seeks bonds with a favorable risk/reward trade-off.

Seeks income from high-quality municipal bonds

- Target average rating: Primarily A- or higher

- Minimum credit quality: Bonds rated BBB- or better at purchase.

- Average target duration: 3 to 5 years

- Maturities: Bonds generally maturing within 20 years

Expected range of credit quality of the bonds in your SMA

Investment-grade municipal bonds typically offer relatively low default rates†

10-year average cumulative default rates (1970-2023)

| Moody's rating category5 | Municipal bonds | Global corporate bonds | |

|---|---|---|---|

| Investment

Grade |

Aaa | 0.00% | 0.36% |

| Aa | 0.02% | 0.77% | |

| A | 0.10% | 2.03% | |

| Baa | 1.09% | 3.61% | |

| Non-Investment

Grade |

Ba | 3.49% | 15.25% |

| B | 17.07% | 34.31% | |

| Caa-C | 25.59% | 51.44% |

†Source: Moody’s Investor Service "US Municipal Bond Defaults and Recoveries", 1970-2023, October 24,2024

Diversified exposure

The Strategy invests in a diverse mix of bonds issued by municipalities such as U.S. cities, counties and states as well as non-profit and public organizations.

The mix includes a range of sectors and varying maturities. A decline in one sector could hopefully be offset by a gain in another, which may help smooth out portfolio volatility.

Invest across the US or focus on your home state

The national portfolio can hold bonds issued within any of the 50 states or U.S. territories, offering broad diversification and income potential.

You can choose state-preference option if your state of residence is California, Massachusetts, or New York. If this option is chosen, the investment team will emphasize in-state bonds to pursue state tax-exempt income, with less focus on national diversification. The proportion of in-state bonds in the portfolio may vary and is not guaranteed to reach 100%.

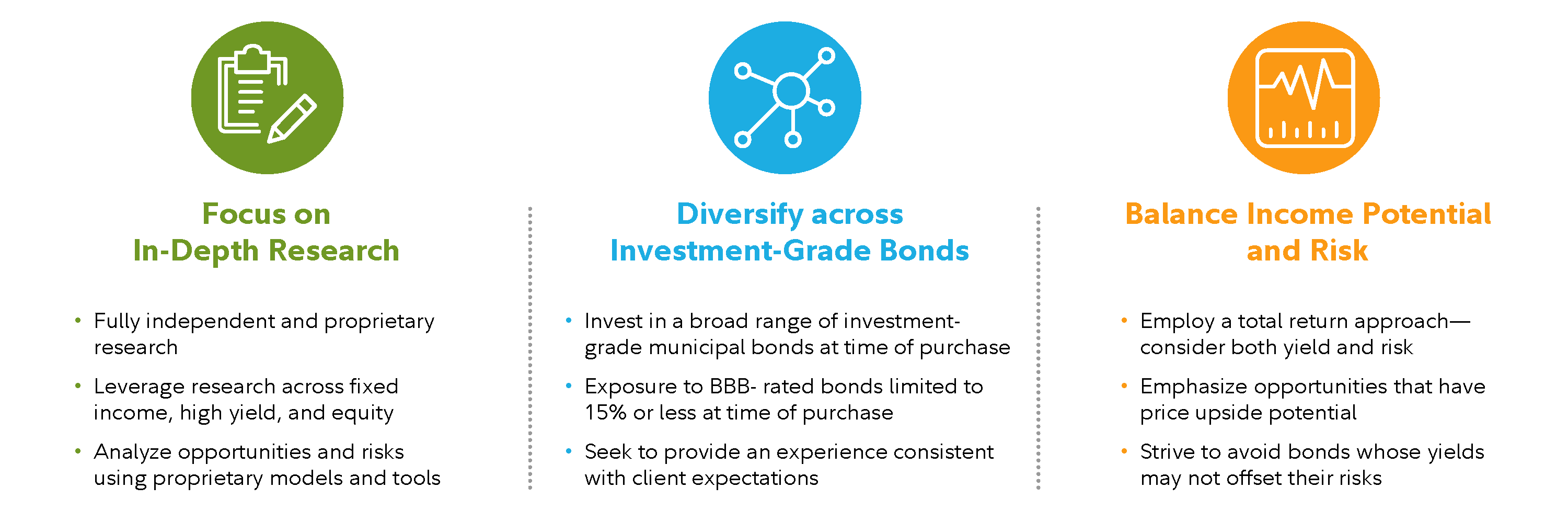

Strives to balance income and price appreciation vs. risk

Using a research-based approach, the investment management team strives to avoid bonds that will not compensate bond holders for their investment risk.

To also help manage risk, the strategy will seek to maintain an average duration6 similar to that of the Bloomberg Managed Money Short/Intermediate (1-10 year) Municipal Bond Index,7 which typically has an average duration of 4-6 years.

In general, portfolios with shorter durations are less sensitive to changes in interest rates than portfolios with longer durations.

Tapping Fidelity's Fixed Income expertise

Strategic Advisers LLC (Strategic Advisers), has engaged Fidelity Management & Research Company LLC (FMR), a registered investment adviser and a Fidelity Investments company, to provide the day-to-day discretionary portfolio management of Fidelity Intermediate Municipal Strategy accounts, including investment selection and trade execution, subject to Strategic Advisers' oversight.

FMR brings investors a rich history of managing fixed income investments for over 50 years.

Using proprietary research, models, and tools, FMR can analyze thousands of securities across the investment-grade taxable bond universe.

This capability allows them to:

- Build a diversified taxable bond strategy

- Support income generation

- Balance risk and return potential

- Help keep your account aligned with your preferences

*Fidelity Investments, as of 12/31/24. Data is unaudited. Fidelity fixed income assets include investment-grade and high-income products, and money market cash management vehicles.

†Fidelity Investments, as of 12/31/24. Data is unaudited. Investment team members include portfolio managers, traders, and research analysts and associates.

Fidelity Fixed Income Division

- $2.3+ Trillion Assets Under Management*

- 50+ years of experience

- Assess individual issuers' value and outlooks

- 200+ team members†

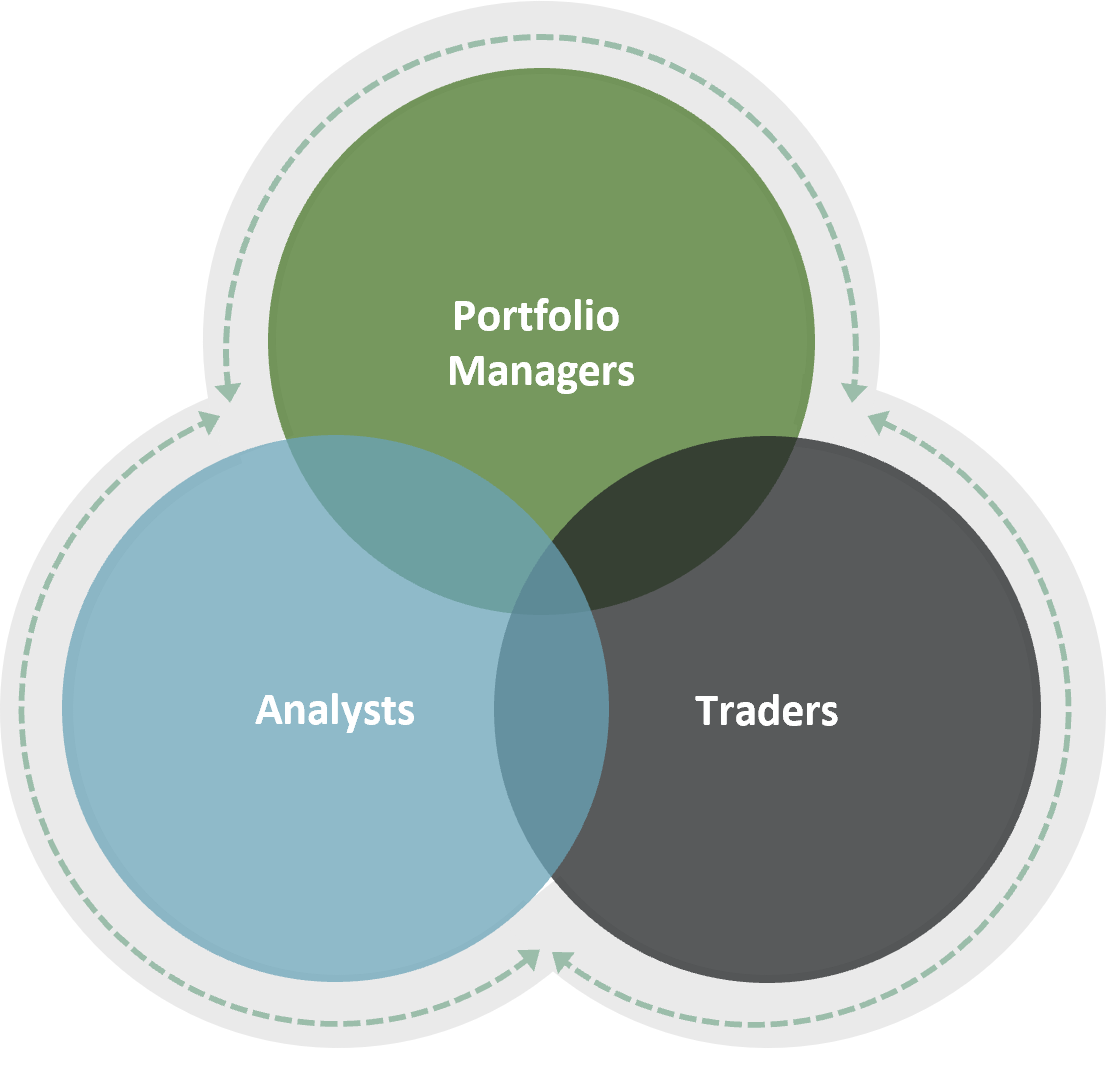

50+ active portfolio managers

- Lead the investment team

- Uses deep market experience to manage portfolios

- Ensure each strategy is managed to its specific objective

- Select appropriate bonds for individual client portfolios

130+ research and credit analysts

- Identify attractive bonds and monitor existing holdings

- Conduct up-front and ongoing credit quality analyses

- Assess individual issuers' value and outlooks

- Employ specialized tools and models

30+ professional traders

- Seek to improve returns by using proprietary technology and timely market knowledge

- Pursue flawless trade execution

Fidelity's Fixed Income division believes investment success is a function of teamwork—involving portfolio managers, quantitative analysts, credit analysts and traders. Their investment team will actively manage your account, putting their knowledge, experience, and resources to work as they seek to uncover opportunities in all types of markets.

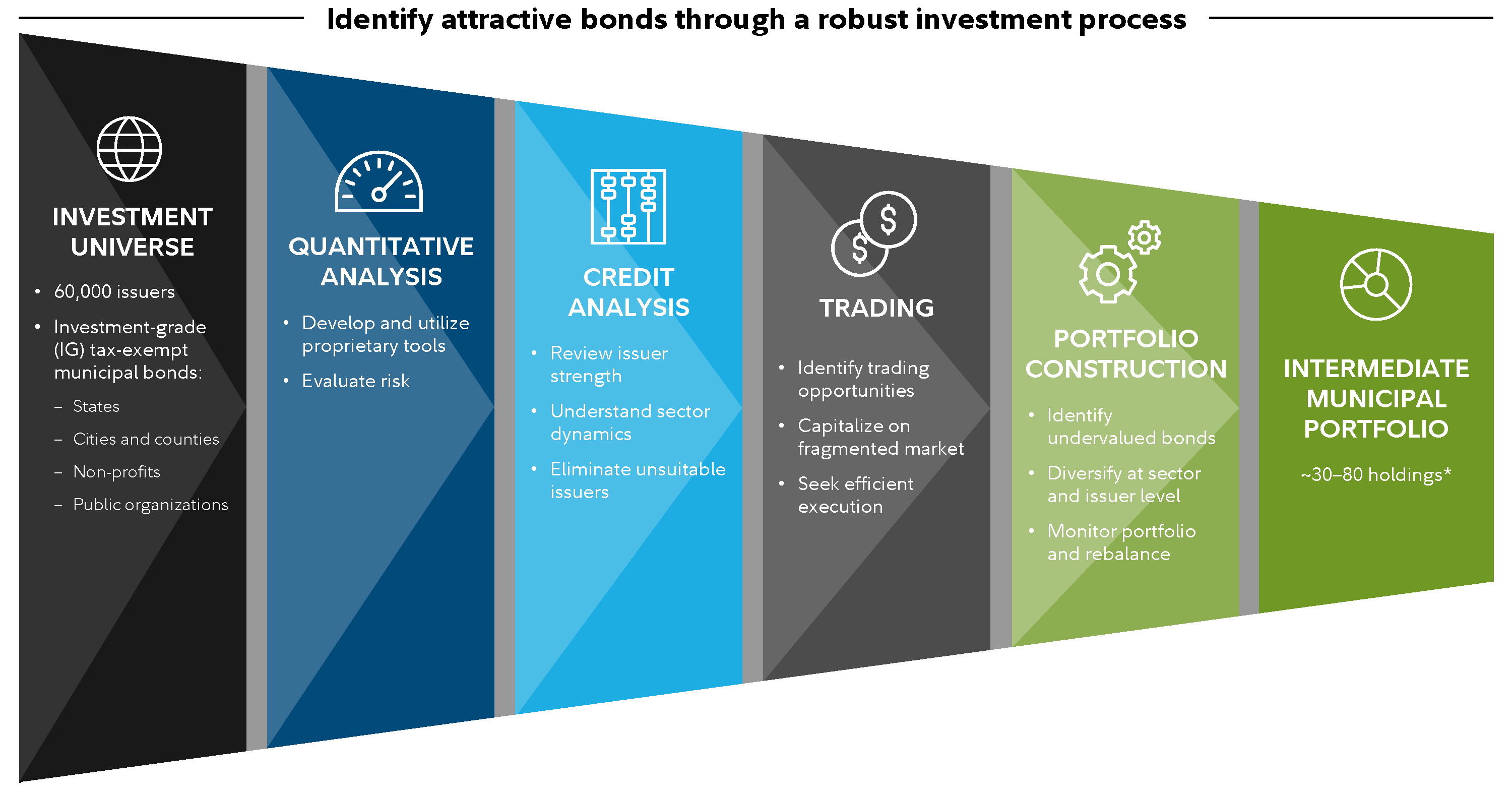

How we select bonds for your account

The investment team looks at many factors when assessing risk for each proposed bond, including but not limited to, issuer specific credit risk, sector risk, interest rate risk, and liquidity risk.

The team assigns a proprietary credit rating to each bond they purchase, which is independent of the rating agencies. The team focuses on selecting investment-grade bonds that offer strong relative value in an effort to generate income while seeking to limit risk to the money invested.

Each account is diversified across a variety of sectors and maturities to help ensure it is not concentrated in any one area, can better handle changes in interest rates, and potentially helps reduce overall risk to principal over the long term.

Diversification does not ensure a profit or guarantee against loss.

Do we hold bonds to maturity?

Bonds can be sold prior to maturity when market opportunities or portfolio needs arise.

While the investment team manages the portfolio with a focus on maintaining low turnover, trades may be made to enhance return potential and manage risk. These decisions are typically driven by factors such as changes in credit quality, relative value opportunities through security selection, strategic yield curve positioning, or evolving cash flow needs.