Fixed Income

|

What is professional active management in bond investing?

Active fixed income SMA portfolio managers take a dynamic approach to managing your money. This dynamic approach differs from some fixed income strategies that hold bonds until they mature and then reinvest the principal into new bonds. Active managers are more likely to sell a bond before it reaches maturity. This can help keep your account aligned with the objective of the SMA strategy you’ve selected.

Active portfolio managers base trading decisions on thorough fundamental and quantitative research. They may trade bonds to help maintain the appropriate level of risk or duration for your strategy, or because they have identified an opportunity to buy bonds they believe are undervalued by the market.

A team-based approach to research and decision-making helps navigate complicated bond markets

Fixed income SMA portfolio managers are responsible for managing each SMA strategy to a specific investment objective – like generating income while limiting the risk to your initial investment. This requires day-to-day monitoring and significant research to make investment decisions within your account.

Extensive research conducted by teams of fundamental and quantitative analysts can help active portfolio managers identify bonds that may be over or underpriced by the market.

The U.S. bond market is valued over $55 trillion and the number of available securities and sector composition continuously evolving. The bond market includes a wide range of issuers – from governments to corporations - and the characteristics of each bond and each issuer can differ significantly.

A large and fragmented market makes it difficult to find the right bond

Source: Fidelity Investments, MSRB, SIFMA Quarterly Report: US Fixed Income, 4Q24, published March, 2025.

The characteristics of an individual bond affect its price and it’s important to know that these prices aren’t fixed. Prices can change over time based on how the market views the characteristics and risk and return potential of an individual bond.

Compared to passive or index strategies, active managers can work with teams of analysts and trading experts to extensively research and select bonds that they believe will help reach each strategy’s investment objective. By combining in-depth credit analyses, sector perspectives and quantitative modeling into a multi-faceted approach, active portfolio managers seek to uncover investment opportunities across a complicated bond market. This can help adapt portfolios to changing market environments and allows active managers the flexibility to seek opportunities for their strategies to outperform traditional benchmarks.

Advantages of SMAs and professional active bond management

SMAs can provide professional investment management and options for personalization to help support your financial goals. They can complement a well-diversified portfolio by providing a targeted approach aligned to a specific investment objective.

|

— May be included |

| Potential Benefits | Fixed Income SMA* | Fixed Income Mutual Funds/Exchange-Traded Funds (ETFs) | Individual Bonds or Passive Bond Ladders |

|---|---|---|---|

| Professional Management

Experienced oversight of the investment strategy |

|

|

|

| Research-Driven Decisions

Extensive multi-factor analysis to help identify opportunities and manage risk |

|

|

|

| Reduced Impact from Fund Flows

Less disruption from other investors' trading decisions |

|

— |

|

| Disciplined Reinvestment

Professionally managed approach keeps your money working for you |

|

|

|

| Diversification Management

Broad diversification across sectors, issuers, yields, and maturities |

|

|

|

| Ongoing Credit Monitoring

Continuous oversight of bond issuer creditworthiness |

|

|

|

| Holdings Transparency

Visibility into the individual bonds within you account |

|

— |

|

| Control of Holdings

Full control over which individual bonds are in your portfolio |

— |

|

|

| Simplicity

Exposure to multiple bonds through a single holding |

|

|

|

| Dedicated Fidelity Advisor

Personalized financial planning support to help you reach your goals** |

|

Extensive research to navigate a large and fragmented bond market

When evaluating bonds for a client’s Fixed Income SMA, active portfolio managers can leverage deep fundamental and quantitative insights from robust research and trading teams. Rather than relying solely on credit ratings from agencies like Moody's or Standard & Poor's, these teams adhere to a rigorous evaluation process in an effort to identity strong investment opportunities within the bond market. Active managers can act on this research to adapt portfolios and manage risk through changing market conditions and interest rate environments.

In addition to up-front and ongoing credit quality analysis, research teams work to provide portfolio managers with insights into:

- How macroeconomic conditions may influence the current and future value of a bond. These conditions could include expectations for economic growth and inflation as well as potential monetary or fiscal policy changes.

- Sector-level dynamics that can help uncover areas of opportunity and inform diversification decisions within each strategy.

- Quantitative modelling that can help assess a bond’s risk relative to its potential return.

- A deep understanding of the financial strength of individual bond issuers, or how well positioned an issuer is to make consistent interest payments and repay a bond in full.

- Current supply and demand dynamics within the fragmented fixed income marketplace.

This kind of multidimensional approach to research can identify attractive bonds that help achieve each strategy's investment objective while striving to avoid bonds that may not compensate investors for their investment risk. This balance can help maintain the potential for a high level of predictable income while limiting the risk to your initial investment.

Ability to seek opportunity to generate returns and manage risk

Active managers generally have the flexibility to look across bond markets for investment opportunities outside of their strategy's benchmark.

The dynamic nature of the holdings in an active Fixed Income SMA and access to extensive research allow active portfolio managers to identify individual bonds that they believe will generate predictable income while seeking to limit the risk to your initial investment in a variety of market environments.

- Sector rotation: Based on insights from research and trading teams, active portfolio managers may seek to generate returns or manage risk by overweighting (holding more of) or underweighting (holding less of) certain sectors relative to a strategy’s benchmark index.

The performance of different sectors can vary significantly from year to year and not all sectors perform the same way at the same time. - Security selection: Sometimes the market price of a bond may not match what active managers believe to be its value as assessed by their research. Active managers may buy bonds that they view as underpriced and sell bonds they believe are overpriced—in other words, buying low and selling high.

Experienced portfolio managers can use macroeconomic, fundamental, and quantitative research to make qualitative assessments about which individual bonds can help achieve the SMA strategy’s specific investment objective. - Yield-curve positioning: This refers to how a portfolio is positioned based on the shape and expected changes in the yield curve.

For example, if a manager extends duration in anticipation declining rates, they’re generally positioning the portfolio for potential capital appreciation. If a manager shortens duration, they’re generally trying to mitigate volatility and the risk to your initial investment.

Duration management helps balance interest rate risk and income potential

The active managers for each Fixed Income SMA strategy manage and monitor portfolios to maintain an average duration that is consistent with their strategy’s benchmark over time. Duration is expressed in years and is a risk characteristic that helps understand how a bond’s price could change when there are changes to interest rates. Active managers tend to focus on duration because it rolls up several bond characteristics such as maturity date and fixed coupon payments into a single number.

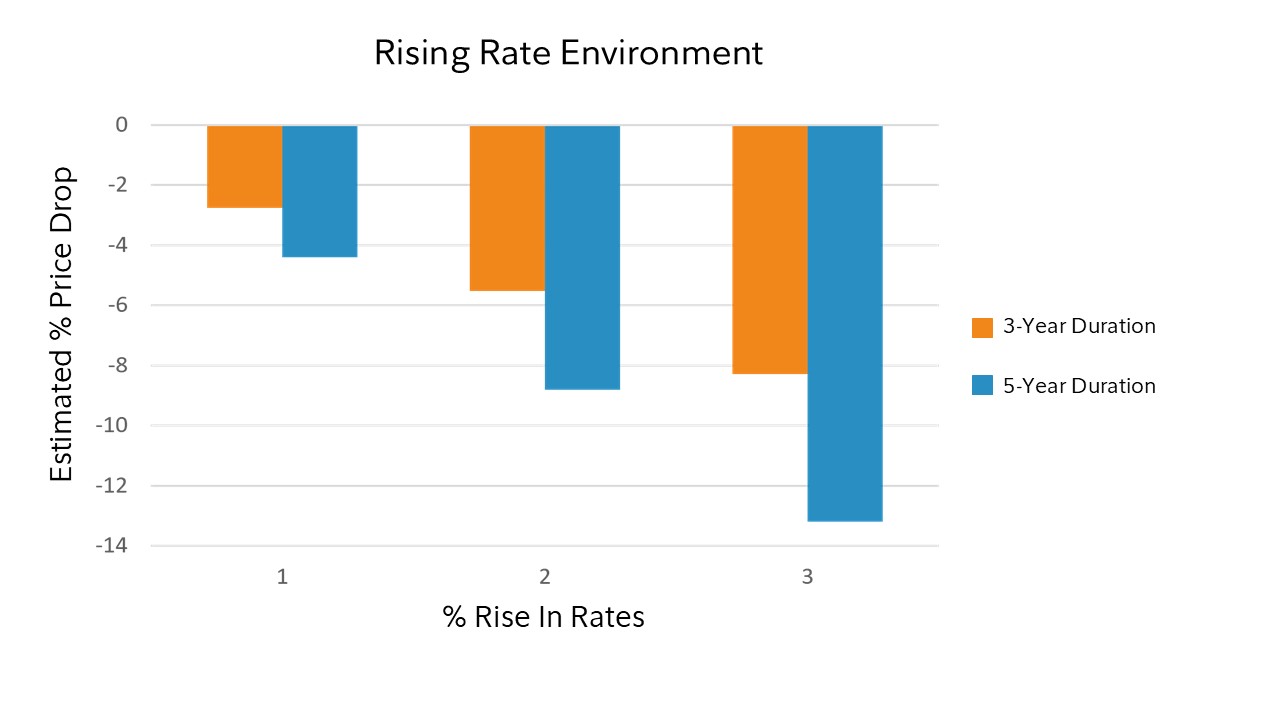

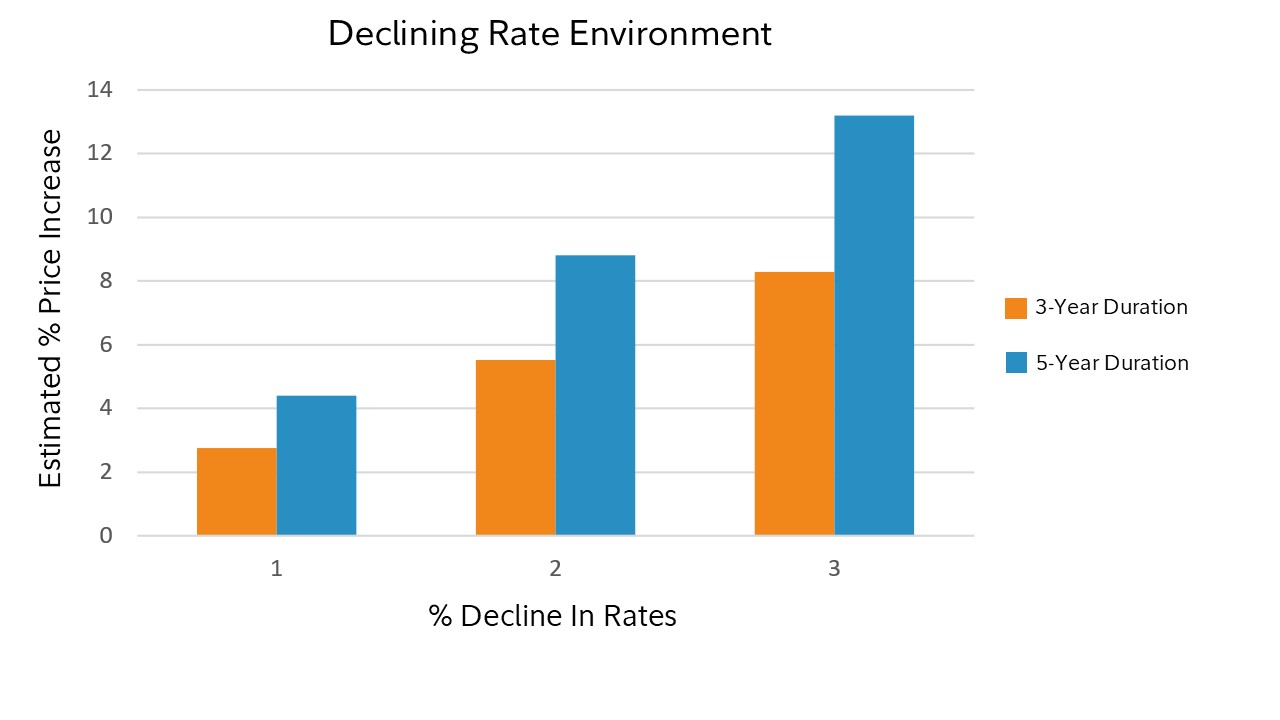

Higher duration indicates that a bond price is more sensitive to interest rate changes, while lower duration indicates less sensitivity to interest rate changes. For example, a bond with a duration of 5 years is likely to experience about a 5% change in price for every 1% change in interest rates. Generally, longer term bonds are more sensitive to interest rate changes and can be expected to change in price more compared to short term bonds when interest rates rise or fall. It’s important to remember that bond prices usually fall when interest rates rise, and vice versa.

Hypothetical example for illustrative purposes only

Duration is a measure of a security's price sensitivity to changes in interest rates. Duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain maturity shortening features (e.g., demand features, interest rate resets, and call options) when applicable. Other factors can also influence a bond value and price.

Read more about the relationship between bond prices, rates, and yields

Intermediate duration fixed income SMA strategies may have greater income potential than a limited duration SMA strategy, but they are also more susceptible to interest rate changes and therefore may have more risk potential than limited duration strategies.

Generally, Fixed Income SMAs at Fidelity are managed to maintain an average portfolio duration within 1 year to 6 months of the strategy’s benchmark. While active managers work to manage average duration at the portfolio level, they may choose to trade individual bonds of shorter or longer duration than the benchmark within your account. Trades may happen prior to a bond reaching maturity if the investment team has identified an opportunity to manage risk or generate income.

An active approach can help the investment team adapt to market conditions like rising or falling rate environments and changes to the yield curve, allowing them to balance an appropriate level of interest rate risk for each strategy while seeking opportunities for greater potential income.

Fidelity® Strategic Disciplines offers fixed income SMA strategies with day-to-day portfolio management provided by Fidelity Investments or Breckenridge Capital Advisors. No matter which strategy you choose, your dedicated Fidelity advisor is available for financial planning conversations and can provide access to investment management solutions based on your financial picture.

For investors seeking federally tax-exempt interest income from municipal bonds

| A dedicated Fidelity advisor with day-to-day bond management provided by Fidelity Management & Research Company LLC | A dedicated Fidelity advisor with day-to-day bond management provided by Breckinridge Capital Advisors, Inc. |

| Fidelity Limited Duration Municipal Strategy: seeks to generate federally tax–exempt interest income while limiting risk to principal over a full market cycle

Average portfolio duration: 2-3 years Credit quality: 80% of bonds rated A- or better at time of purchase Holdings: 30-80 individual bonds |

Breckinridge Limited Duration Municipal Strategy: seeks to limit risk to principal while generating federally tax-exempt interest income

Average portfolio duration: 2-3 years Credit quality: 100% of bonds rated A- or better at time of purchase Holdings: 20-50 individual bonds National and state preferences available: CA, MA, MD, NJ, NY, VA |

| Fidelity Intermediate Municipal Strategy: seeks to generate federally tax-exempt interest income while limiting risk to principal over a full market cycle.

Average portfolio duration: 3-5 years Credit quality: 85% of bonds rated A- or better at time of purchase Holdings: 30-80 individual bonds National and state preferences available: CA, MA, NY |

Breckinridge Intermediate Municipal Strategy: seeks to limit risk to principal while generating federally tax-exempt interest income.

Average portfolio duration: 4-5 years Credit quality: 100% of bonds rated A- or better at time of purchase Holdings: 20-50 individual bonds National and state preferences available: CA, MA, MD, NJ, NY, VA |

For investors seeking income from taxable bonds

| A dedicated Fidelity advisor with day-to-day bond management provided by Fidelity Management & Research Company LLC |

| Fidelity Limited Duration Bond Strategy: seeks income from investment-grade bonds while limiting risk to principal over a full market cycle

Average portfolio duration: 2-3 years Credit quality: 60% of bonds rated A- or better at time of purchase Holdings: 30-80 individual bonds plus shares of the Fidelity Limited Term Securitized Completion Fund (FLTGX)—a proprietary, zero-expense ratio fund that provides exposure to securitized bonds.* *The completion fund is a proprietary mutual fund that has an expense ratio of zero and is designed exclusively for use in our managed account programs. The fund is limited to no more than 50% of portfolio weight at time of purchase. |

| Fidelity Core Bond Strategy: seeks income from investment-grade bonds while limiting risk to principal over a full market cycle.

Average portfolio duration: 3-5 years Credit quality: 85% of bonds rated A- or better at time of purchase Holdings: 30-80 individual bonds plus shares of Fidelity ETF (FSEC) providing exposure to securitized bonds.** **Limited to no more than 50% of portfolio weight at time of purchase. |

What happens after you fund your account

Once your account has been fully funded, our team of investment professionals will begin building your portfolio. While this process generally takes 2-3 weeks, we take a thoughtful approach to portfolio construction, so it may take up to 3 months to complete. There are a number of factors that could impact this timeline, including the amount of your initial investment, the strategy you’ve chosen, and whether you’re funding with securities or cash. For instance, if you fund your account with eligible bonds that don’t fit the strategy or represent concentrated positions within your overall portfolio, we will first determine what may need to be sold first, versus what can be sold over time.

Ongoing research, trading, and portfolio management

Fixed income teams of researchers, traders, and portfolio managers, continually leverage proprietary research in search of fixed income opportunities.

Each business day, the team will track the bonds you own, as well as the bonds eligible for your account, analyzing a range of risk factors. The goal is to find the most appropriate mix of bonds for your income goals and risk tolerance.

The markets are continuously monitored for opportunities, including shifts in interest rates or changes in bond valuations. If it's possible to increase the amount of income your account produces without increasing the risk to the initial investment, adjustments may be made accordingly.