Breckinridge Intermediate Municipal StrategyA separately managed account investing in high-quality, investment-grade municipal bonds, which seeks to deliver interest income exempt from federal income taxes while limiting risk. This actively managed strategy looks to maintain an average target duration of 3 to 5 years. |

Investment strategy: Seeks to limit risk to principal while generating federally tax-exempt interest income.

Types of investments: Primarily high-quality investment-grade1 municipal bonds at time of purchase

Investment minimum: $350,0002

Gross annual advisory fee: 0.35% – 0.40%3 (varies based on total assets invested)

- Designed for investors seeking a professionally managed, diversified bond portfolio that balances the pursuit of federal tax-exempt interest income—including income exempt from the alternative minimum tax (AMT)— with a consistent focus on risk management.

- Managed by a firm with extensive investment-grade municipal bond experience, with a focus on risk mitigation.

- Active management allows the portfolio to hold bonds to maturity or sell them earlier—not only to manage interest rate risk and seize market opportunities but also support other portfolio objectives—while maintaining target duration.

- A research-based approach that balances the opportunity to generate income and capital appreciation with a focus on risk management.

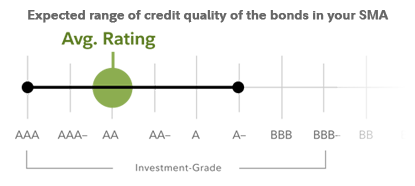

Focus on high-quality bonds

- Target average rating: Primarily AA or higher

- Minimum credit quality: Bonds rated A- or better at purchase4

- Average target duration: 3 to 5 years

- Maturities: Bonds generally maturing within 15 years

Expected range of credit quality of the bonds in your SMA

Diversified exposure

The Strategy invests in a diverse mix of bonds issued by municipalities such as U.S. cities, counties and states as well as non-profit and public organizations.

The mix includes a range of sectors and varying maturities. A decline in one sector could hopefully be offset by a gain in another, which may help smooth out portfolio volatility.

Invest across the US or focus on your home state

The national municipal bond portfolio has the flexibility to invest in bonds issued by entities in all 50 states, offering broad diversification and income potential.

If you pay state taxes in any of the following states, you can choose to prioritize bonds from that state:

- California

- Colorado

- Connecticut

- Georgia

- Maryland

- Massachusetts

- Minnesota

- New Jersey

- New York

- North Carolina

- Ohio

- Pennsylvania

- South Carolina

- Virginia

Applying this state preference can help generate interest income exempt from state taxes. The proportion of instate bonds in your portfolio may vary and is not guaranteed to reach 100%.

Even if you've selected a state preference, adding bonds from other states can offer important benefits:

- Increased income potential

Some out-of-state bonds may offer higher yields, even after state taxes have been factored in. - Greater diversification

Investing in bonds from multiple states can help reduce risk, especially if your home state encounters financial challenges. - Additional investment options

Access to a wider universe of municipal bonds increases the availability of investment opportunities, enhancing the portfolio manager's ability to pursue favorable yields and credit quality.

Learn more: Understanding the Potential Benefits of Out-of-State Municipal Bonds (PDF)

Balance income and price appreciation vs. risk

By maintaining a portfolio of investment-grade municipal bonds, with a significant portion having a credit rating of AA or higher, Breckinridge Intermediate Municipal Strategy is built to help limit risk to your investment and to seek a steady, reliable stream of income over the long term.

The strategy has a philosophy centered on a research-based approach that balances the opportunity to generate income and capital appreciation with a focus on risk management.

To also help manage risk, the strategy targets an average duration5 similar to the duration of the Bloomberg Managed Money Short/Intermediate (1–10 years) Municipal Bond Index.6 A duration in this mid-range helps reduce the impact from interest rate changes in comparison to strategies that have longer duration.

Investment-grade municipal bonds typically offer relatively low default rates†

10-year average cumulative default rates (1970-2023)

| Moody's rating category7 | Municipal bonds | Global corporate bonds | |

|---|---|---|---|

| Investment

Grade |

Aaa | 0.00% | 0.36% |

| Aa | 0.02% | 0.77% | |

| A | 0.10% | 2.03% | |

| Baa | 1.09% | 3.61% | |

| Non-Investment

Grade |

Ba | 3.49% | 15.25% |

| B | 17.07% | 34.31% | |

| Caa-C | 25.59% | 51.44% |

†Source: Moody’s Investor Service “US Municipal Bond Defaults and Recoveries, 1970-2023, October 24,2024

To also help manage risk, the strategy targets an average duration5 similar to the duration of the Bloomberg Managed Money Short/Intermediate (1–10 years) Municipal Bond Index.6 A duration in this mid-range helps reduce the impact from interest rate changes in comparison to strategies that have longer duration.

Predictable tax-exempt income

Depending on your tax bracket, the after-tax return on municipal bonds may be more beneficial than those offered by taxable bonds. A key benefit of municipal bonds, particularly for investors in high tax brackets, is their ability to offer federally tax-exempt interest income. Interest income from some municipal bonds may also be free from state income tax, depending on your state of residency.

All or a portion of the income may be subject to the federal alternative minimum tax. Income attributable to capital gains are usually subject to both state and federal income taxes.

Tax rates 38.8% and 40.8% include a Medicare surtax of 3.8% imposed by the Patient Protection and Affordable Care Act of 2010

Municipal bond expertise, delivered through separately managed accounts

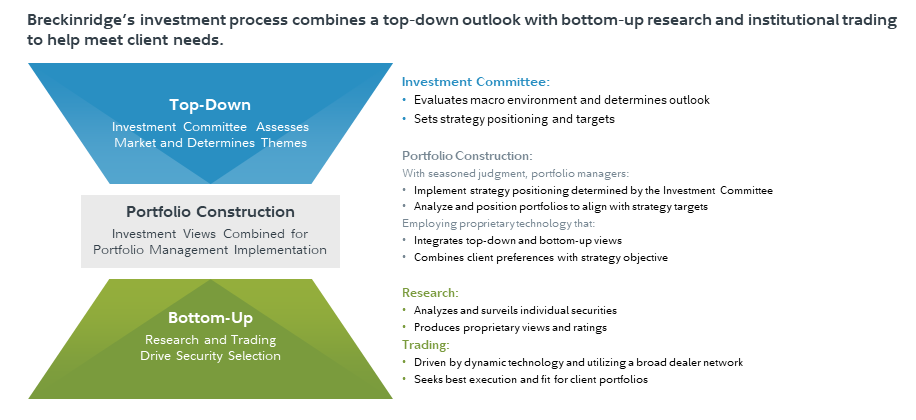

Strategic Advisers LLC (Strategic Advisers), has engaged Breckinridge Capital Advisors, a registered investment adviser, to provide the day-to-day discretionary portfolio management of Breckinridge Intermediate Municipal Strategy accounts, including investment selection and trade execution, subject to Strategic Advisers' oversight.

About Breckinridge Capital Advisors

Breckinridge Capital Advisors is a Boston-based, independently owned asset manager working to provide the highest caliber of investment management. They serve high-net-worth individuals and large institutions through a network of financial advisors, consultants, and family offices.

What sets them apart

Their investment approach is defined by:

- Disciplined portfolio management

- Rigorous fundamental credit analysis

- Customization at scale through separate accounts

- A proprietary technology platform that enhances efficiency and insight

Investment Philosophy

They aim to strike the right balance between managing risk and seeking returns. Through in-depth, bottom-up research, efficient trading, and the seasoned judgment of their portfolio managers, they work to enhance risk-adjusted returns for clients.

1993 |

Year foundedExperienced asset manager with offices in Boston and San Diego. |

|---|

$52+ BILLION* |

Assets under managementCustomized separately managed accounts. |

|---|

80+ EMPLOYEES |

Professionals30 of which are portfolio managers, traders, analysts, and co-Chief Investment Officers (CIOs). Source: Breckinridge Capital Advisers, *AUM as of 06/30/25. Employee figures as of 07/01/2025. |

|---|

Breckinridge's proprietary technology and broad network of over 140 dealers allows the firm to trade municipal bonds efficiently by providing:

- The flexibility to find value in both the primary and secondary markets.

- The ability to take advantage of opportunities in both large and smaller lot sizes.

- The capacity to seek lower transaction costs relative to the broader market.

How will Breckinridge select bonds for your account

Breckinridge will select all securities for your account.

Their research team assesses risk for each proposed bond, using national credit ratings and their own proprietary analysis. This proprietary analysis includes investment quality, price, default, and call and liquidity risk. The team focuses on selecting top-rated securities in an effort to limit risk to your original investment, and with the goal of holding them to maturity to generate a predictable income stream.

Each account may consist of a variety of issuers, geographies, sectors, maturities, etc., to help ensure it is not concentrated in one area. Your account will align with your personal tax situation, your comfort with risk and your cash flow needs.

Diversification does not ensure a profit or guarantee against loss.

Does Breckinridge hold bonds to maturity?

While the primary intent is to hold bonds to maturity, positions may be sold earlier when market conditions warrant or when compelling opportunities arise.

The portfolio is generally managed with low turnover in mind; however, trades may occur to support income generation and risk management objectives.