Tax-smart investing

Taxes can have a significant impact on your investment returns. We seek to apply a range of different tax-smart investing strategies designed to help you keep more of what you earn, so your money stays invested and working for you.

Unlike some firms that simply wait until year end to harvest tax losses, we take an ongoing, tax-efficient approach that seeks to enhance after-tax returns—when we establish your portfolio, in our day-to-day management of your investments, and when you need to withdraw money.

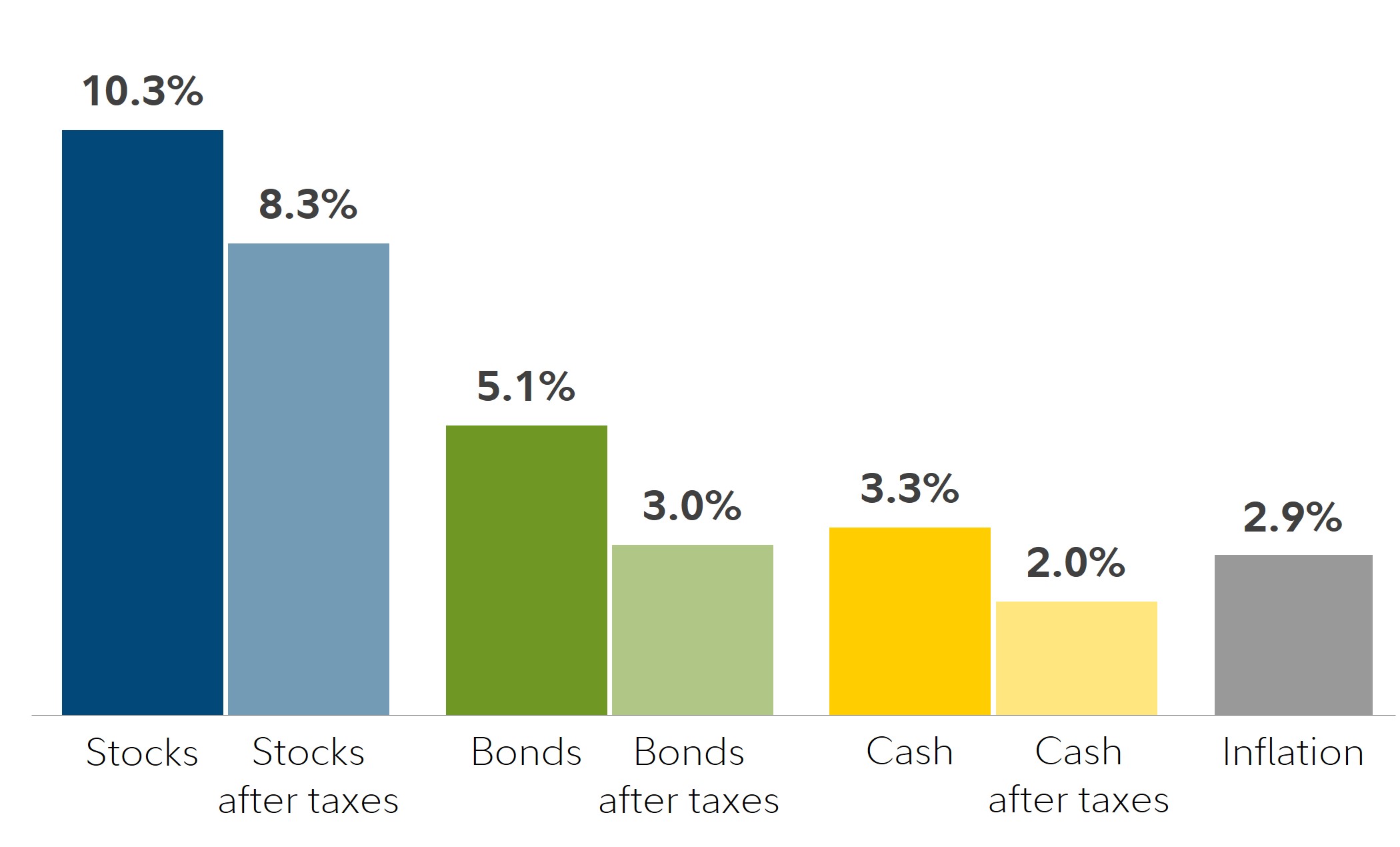

Taxes Can Significantly Reduce Returns2

AVERAGE ANNUAL RETURN PERCENTAGE

HISTORIC MARKET PERFORMANCE: 1926—2023

FOR ILLUSTRATIVE PURPOSES ONLY.

More information

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Other than with respect to assets managed on a discretionary basis through an advisory agreement with Strategic Advisers LLC, you are responsible for determining whether, and how, to implement any financial planning recommendations presented, including asset allocation suggestions, and for paying applicable fees. Financial planning does not constitute an offer to sell, a solicitation of any offer to buy, or a recommendation of any security by Fidelity Investments or any third party.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Asset location

For qualifying goals, we may strategically position assets across your Personalized Portfolios accounts based on their tax registration to help enhance your after-tax returns. Asset location may also increase the impact of some of our other tax management strategies.

Harvest tax losses2

If we sell positions in your account at a loss, those losses can be used to offset gains in your Personalized Portfolios accounts or elsewhere in your portfolio, which can help reduce your tax liability in either the current year or in future years.

Invest in municipal bond funds or ETFs

When it makes sense based on your tax rate, we may seek to provide exposure to municipal bonds, whose interest may be exempt from federal taxes. Depending on your state of residence, interest may also be exempt from state and local taxes.

Manage capital gains

When possible, we may realize long-term capital gains instead of short-term gains, which may reduce your tax obligations.

Manage exposure to distributions

We'll seek investments that pay out fewer or no distributions to help reduce your tax obligations.

Tax-smart rebalancing

As markets move and your mix of investments shifts, we'll consider the potential tax impact of trades we make on your behalf when maintaining the appropriate level of risk.

Transition management

We search for ways to integrate your existing eligible holdings3 into your managed account as opposed to selling all of your existing investments in order to "start from scratch." This can help reduce the potential tax consequences of creating your personalized investment strategy.4

Tax-smart withdrawals

When you need to withdraw money, we'll seek to reduce the tax impact of those withdrawals when selecting which holdings to sell.

More information

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Other than with respect to assets managed on a discretionary basis through an advisory agreement with Strategic Advisers LLC, you are responsible for determining whether, and how, to implement any financial planning recommendations presented, including asset allocation suggestions, and for paying applicable fees. Financial planning does not constitute an offer to sell, a solicitation of any offer to buy, or a recommendation of any security by Fidelity Investments or any third party.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917