Asset location

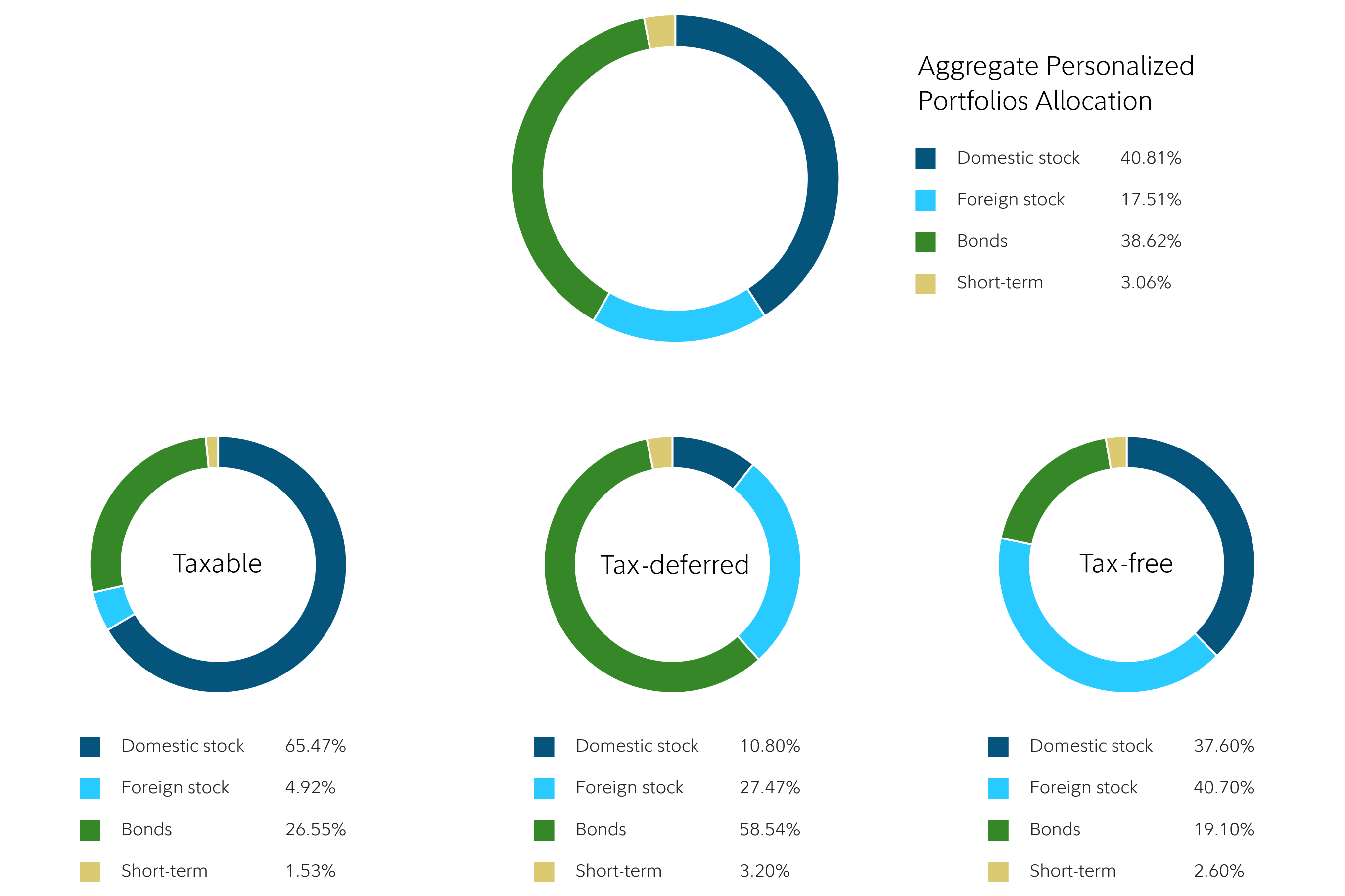

In situations where it's appropriate, we try to be mindful of the types of assets we place in accounts that have different tax treatments. This approach, known as asset location, can help enhance after-tax returns. If an investment is held in a taxable account, selling it could result in you owing taxes on any realized gains. But even if you don't sell an investment, you may owe taxes if it distributes income as capital gains or dividends. By nature, some investments tend to be better suited to account types with certain tax registrations. We try to factor this into the investment decisions we make on your behalf.

Here's how we'll place different investments across account types

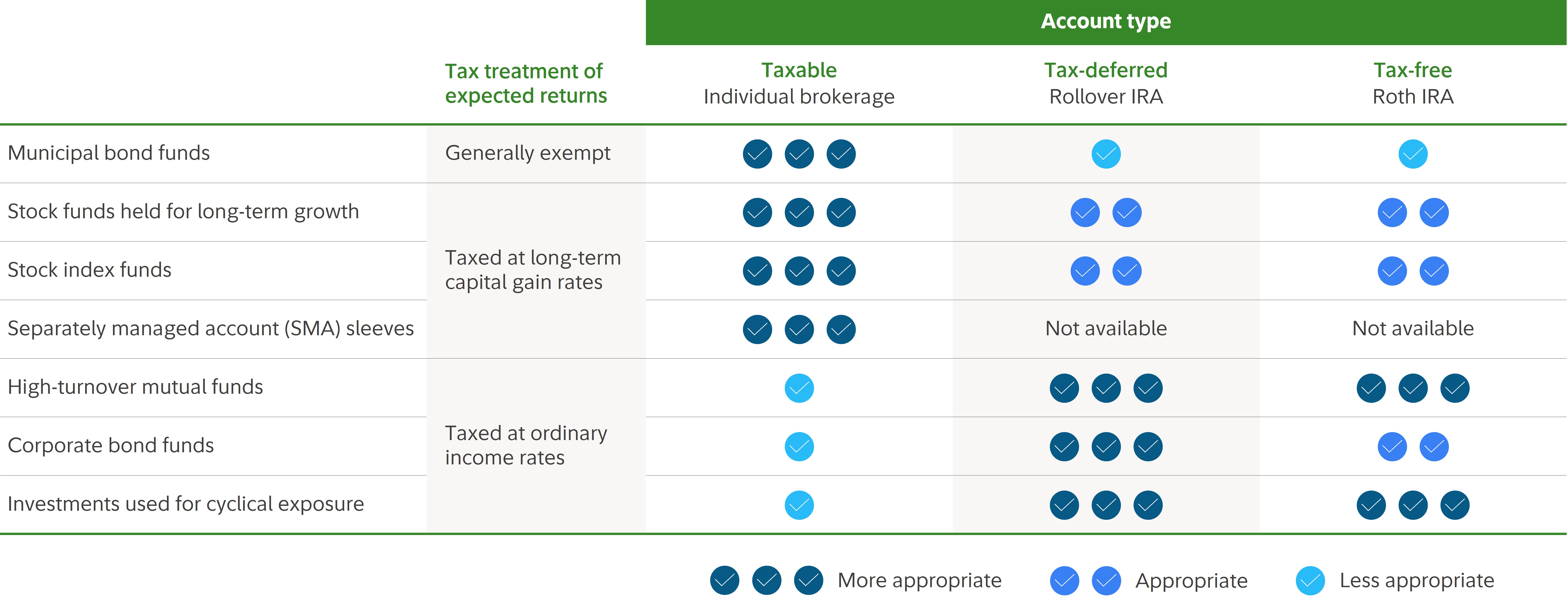

As the table below shows, different types of accounts lend themselves to different types of assets. We use this as a guide when developing your overall portfolio strategy.

- Taxable accounts, such as traditional brokerage accounts, may hold securities (stocks, bonds, mutual funds, ETFs) that are taxed when you earn dividends or interest, or when you realize capital gains by selling investments that have increased in value.

- Tax-deferred accounts like IRAs, allow payment of taxes to be delayed until money is withdrawn, for qualified withdraws.

- Tax-free accounts like Roth IRAs,3 require contributions to be made with after-tax dollars and do not provide a tax deduction up front, but they allow the investor to avoid further taxation (as long as the rules are followed).

Remember, contribution limits* prevent investors from simply saving everything in retirement accounts.

| Taxable Account | Tax-Deferred | Tax-Free | |

|---|---|---|---|

| Example | Individual brokerage account | Rollover IRA | Roth IRA |

| When earnings are taxed | Annually | Upon distribution | N/A** |

| Investments we may emphasize | Investments offering long-term growth potential that generally distribute income less frequently | Investments that offer total return potential that generally distribute income more frequently | Investments that offer high growth potential |

| Why we may emphasize them | To help reduce capital gains or interest distributions in effort to manage a client's tax obligations | To reduce any immediate potential tax impact | To provide tax-exempt, long-term growth opportunities |

* 2025 contribution limits

- $7,000 to a Roth or traditional IRA. If you're 50 or older, the limit is $8,000.

- $23,500 to a 401(k)/403(b) or $31,000 if you're 50 or older. An important note: Beginning in 2025, those between ages 60 and 63 will be eligible to contribute up to $11,250 as a catch-up contribution, if your plan allows.

- If you have a 401(k) match, the combined limit is $70,000, or $77,500 if you're 50 or older, or 100% of your salary if it's less than the dollar limits.

** Unless a non-qualified distribution takes place, where additional tax penalties may apply.

As the table below shows different types of investments may be more or less appropriate for different types of accounts once those accounts' tax treatments are considered.

For Illustrative purposes only. Funds can represent Mutual Funds and Exchange Traded Products. There are no guarantees as to the use or effectiveness of the tax-smart investing techniques, including the coordinated use of different account types and investments, in an effort to reduce a client’s overall tax liabilities.

The potential impact of asset location

Read our study (The Potential After-Tax Benefits of a Coordinated Approach to Multi-Account Management (PDF)) on how a coordinated investment approach using asset location could enhance after-tax returns.

Our study shows a coordinated account management approach using asset location has the potential to add a cumulative 4.6% to 12.7% in after-tax returns over 30 years. This is in addition to any increase in after-tax returns generated using other tax-smart investing techniques.

The study was conducted by applying tax management rules to index returns for multiple secondary asset classes. It does not represent the actual or projected performance of any Fidelity® Wealth Services product offering or investment management capability.