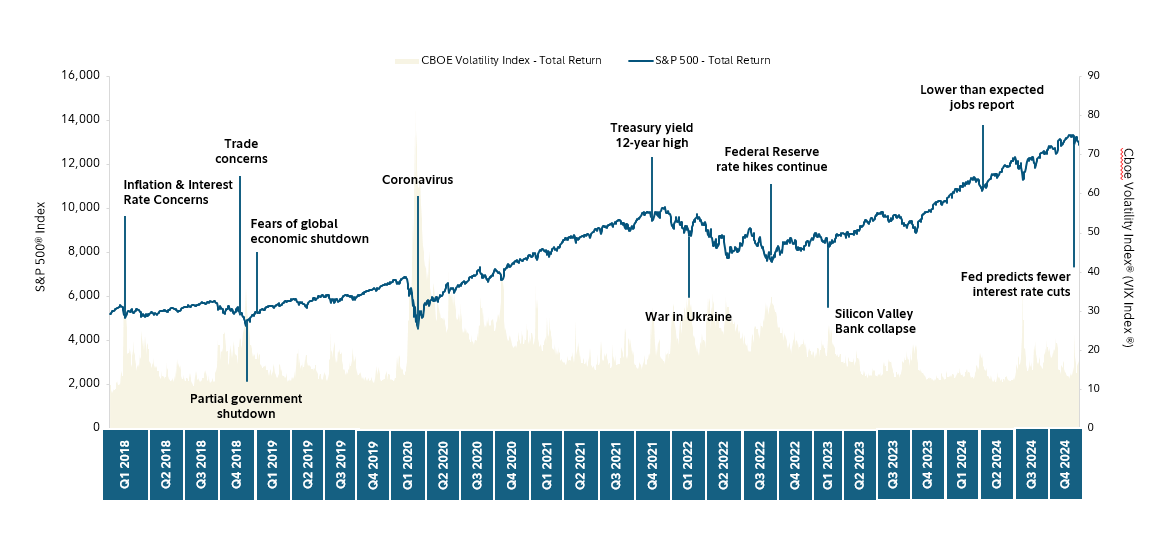

*Source: Fidelity Investments, Bloomberg Finance, L.P., January 1, 2018–December 31, 2024

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Indexes are unmanaged. It is not possible to invest directly in an index.

The Cboe Volatility Index is a weighted average of prices on S&P 500 Index options with a constant maturity of 30 days to expiration. It is designed to measure the market’s expectation of near-term stock market volatility.

The S&P 500 Index is a market capitalization–weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance and has been licensed for use by Fidelity Distributors Corporation.

The data represents the S&P 500 Index Total Return that includes the reinvestment of dividends.

Generally, among asset classes stocks are more volatile than bonds or short-term instruments and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Although the bond market is also volatile, lower-quality debt securities including leveraged loans generally offer higher yields compared to investment grade securities, but also involve greater risk of default or price changes. Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market or economic developments, all of which are magnified in emerging markets.

Advisory services provided for a fee through Strategic Advisers LLC (Strategic Advisers), a registered investment adviser. Discretionary portfolio management provided by its affiliate, Fidelity Management & Research Company LLC (FMR), a registered investment adviser.

Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. Strategic Advisers, FMR, FBS, and NFS are Fidelity Investments companies.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917