A growing number of states require high schoolers to study personal finance to graduate, but that’s new as of 2020. In 2018, only four states had this requirement. Teens still pick up their money habits from their parents, and need practice with budgeting, saving, and finally investing—the steepest learning curve of all.

Meanwhile, parents of teens aren’t confident about teaching financial literacy. And letting teens experiment on their own, especially with investing, can feel risky. How might we encourage meaningful conversations about money at home, and help teens make sound financial decisions?

The Fidelity Youth Account team envisioned a solution involving hands-on learning: a brokerage account with debit card access for 13- to 17-year-old teens. As they developed this new account type, they joined forces with Fidelity Labs’ Digital Studio team to learn more about designing an engaging product experience for teens and to validate their business idea.

Led by Diana Nicholson, the Digital Studio team established Fidelity’s first Teen Advisory Board. In this case study, she shares their fresh approach to gaining a broad understanding of the teen market.

Diana, how would you describe the Digital Studio team at Fidelity Labs?

The Digital Studio team marries Fidelity Labs’ digital product and design expertise with the deep go-to-market expertise of our core businesses, forging innovation super teams across Fidelity.

Can you tell us about how the team furthers Fidelity Labs’ mission, and innovation at Fidelity as a whole?

Fidelity has a firmwide commitment to innovation, which is why a business unit like Fidelity Labs exists. We have a track record of building new businesses, and as a result, we’ve developed a tried-and-true methodology for researching new opportunities and refining product concepts.

We saw an opportunity to share our learnings with strategic new ventures within our core businesses—and found that many teams were eager to collaborate.

Let’s walk through the Digital Studio practice through the lens of one of your more memorable projects. Is there one that stands out to you?

I could list several. We’ve worked on student debt; we’ve worked to optimize charitable giving. That said, the Fidelity Youth Account is a great example of our fast-paced approach to validating and iterating on a solution for a new target market.

Who is the target market and what is the need we’re trying to solve?

The target market is teens. We’re helping parents empower teens with the financial literacy they need to thrive as adults.

Financial literacy is a broad topic. How do parents feel about the task at hand?

They’re understandably anxious about it. They’re not confident about the breadth of their financial knowledge—and they’re even more unsure about how to translate what they know in a way that their kids will understand and respond to. Plus, letting teens practice spending, saving, and investing without supervision can feel risky.

Does Fidelity have existing products for teenagers?

No, the Fidelity Youth Account is the first of its kind. It’s a brokerage account with debit card access for 13- to 17-year-olds, featuring an intentionally low barrier to entry. They can get started with as little as one dollar. The Fidelity Youth Account is meant to be used with some guidance from parents and guardians.

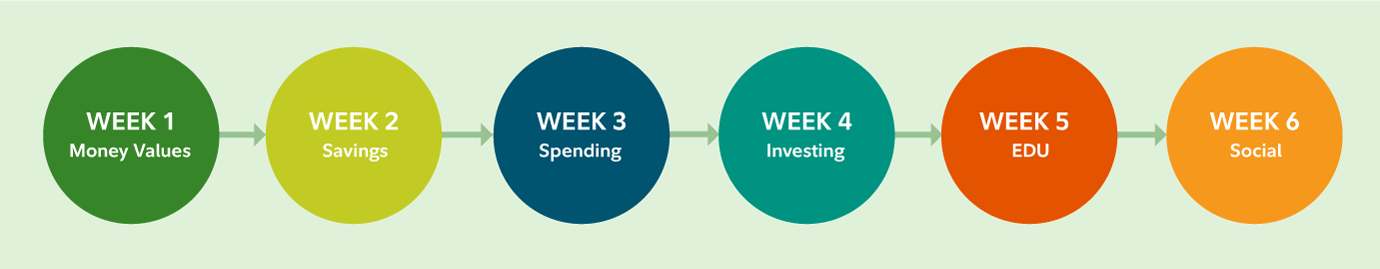

The Digital Studio team gained a broad understanding of teens in only six weeks.

Got it. So, the teens are the primary users, and parents or guardians are the secondary users. And teens are a new target market for us. How did the Digital Studio team get to know these teens?

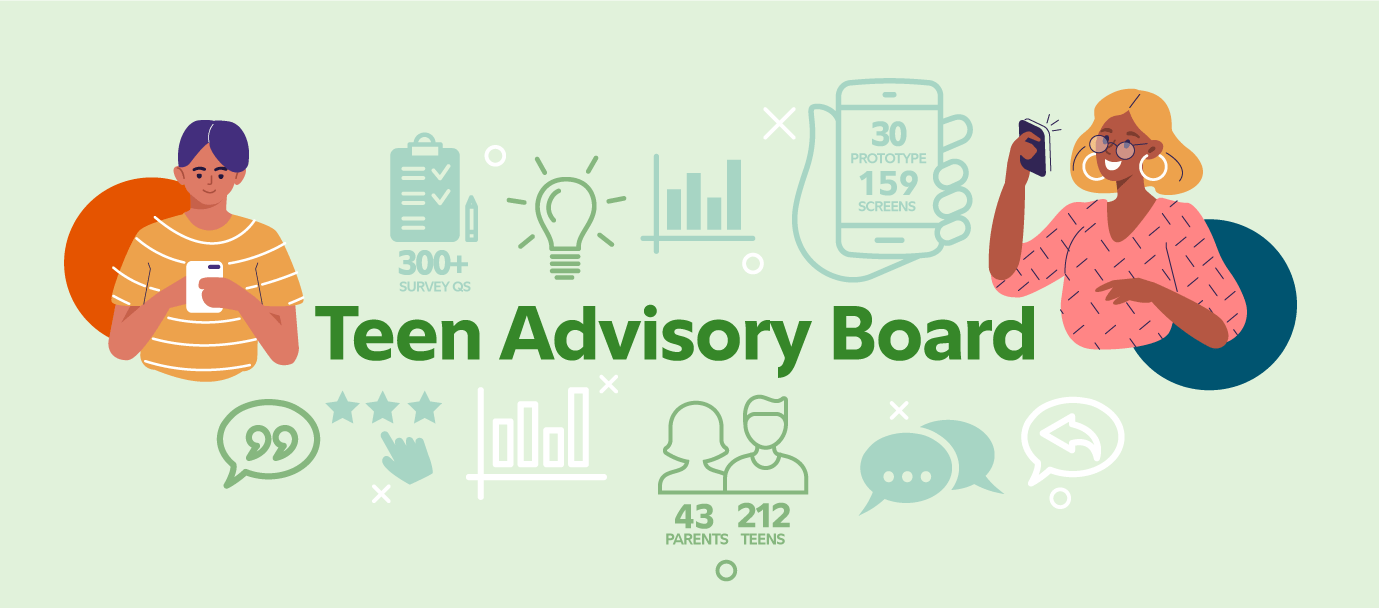

We wanted to gain a broad understanding of teens as quickly as possible. So, we created our first-ever Teen Advisory Board. We invited 63 teen collaborators to help us design the Fidelity Youth Account experience.

Highlights from the DS team market research with teens.

It could be challenging for teenagers at the beginning of their personal finance journey to provide feedback on a financial product.

We kept in mind that teens might be starting from square one with money management. But we also considered that they’d have their own attitudes and assumptions about money and investing. We spent a lot of time in group discussions to understand where they are coming from, which helped us more accurately interpret their feedback on the product concepts. Plus, our brainstorming and testing focus groups were combined with Fidelity guest speaker presentations on personal finance, money management, and investing.

Anything surprising or interesting about the way that teens and parents wanted to use the Fidelity Youth Account?

We discovered that access to investing was a major differentiator from other financial tools available to teens. Parents are excited about having a way to let their teens learn by doing while they retain their role as a kind of emergency brake. And teens are looking for a product that takes them seriously. They liked that the account gives them access to what has traditionally been an adult activity, and while they don’t want a dry, overly technical experience, they also rejected features that mixed in too much fun (e.g. social sharing).

How did these insights inform your final deliverable to the Fidelity Youth Account team?

The research informed the Youth Account team’s decision to prioritize the investing experience and features early on. They were also able to build in a suite of teen-specific educational content as part of the pilot experience, geared toward explaining key concepts without talking down to them.

The Fidelity Youth Account launched in May 2021. Any updates to share?

We’re pleased to report that tens of thousands of accounts have been opened. We’d also like to add that our learning materials continue to drive a strong response from our teen audience.

Investing involves risk, including risk of loss.

The Fidelity® Debit Card is issued by PNC Bank, N.A., and the debit card program is administered by BNY Mellon Investment Servicing Trust Company. These entities are not affiliated with each other or with Fidelity. Visa is a registered trademark of Visa International Service Association, and is used by PNC Bank pursuant to a license from Visa U.S.A. Inc.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917.

1036541.1.0