A growing body of research indicates that ESG (environmental, social, and governance) investing has reached a tipping point. Amid the news events of 2020 and calls for social change, investors are increasingly interested in the purpose and impact of their investments.

Still, many financial advisors have found it challenging to enter this discussion. Building an ESG offering can be time-consuming. And talking to clients about their values can be awkward.

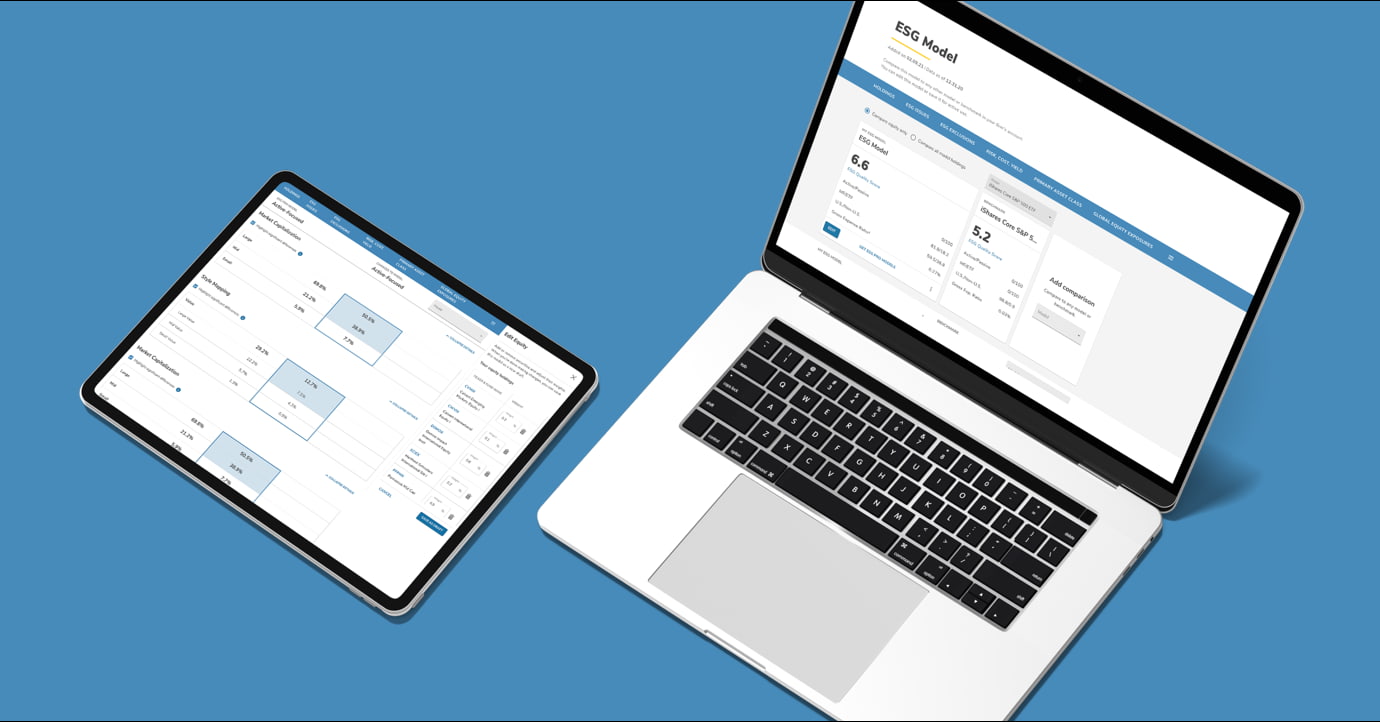

Fidelity ESG ProSM, which originated as an internal startup at Fidelity Labs, was founded on the belief that ESG investing can be a powerful way for financial advisors to attract, engage, and retain clients. Advisors can contribute to a more meaningful client experience by helping clients align their investments with their values.

The solution, which is now under the Fidelity Institutional Adviser LLC (“FIWA”) investment adviser, aims to streamline the work of starting an ESG investing practice and is now available to RIAs in the United States. Carin Stimolo, vice president of client experience, discusses the team’s customer-centric design process.

What challenges do advisors face in embracing ESG?

Building an ESG investing practice can be complicated and time-consuming. First, RIAs need to create and validate their ESG investment offering. Then, they need to understand their clients’ personal values, and show them how ESG models can align with their values.

Speaking of values: These are so personal, they’re not likely to come up in a traditional investing conversation. How do financial advisors feel about delving into their clients’ deeply held beliefs?

Client conversations can be tricky when you get into deeply held values and beliefs. In our research, most advisors prefer to steer clear of situations where they could run into moral or ethical judgments or differences of opinion. Advisors would rather wait for their clients to bring up ESG or sustainable investing, in order to avoid those uncomfortable conversations.

“We believe that holistic approach to investing, based on connecting clients’ values to investments, can be powerful and differentiating.” – Carin Stimolo

How does ESG Pro address these concerns?

We developed an interactive questionnaire, ESG Pro’s Values Discovery Quiz. The quiz helps advisors uncover clients’ motivations for ESG investing, as well as the ESG topics, or values, that matter most to their clients. Once the quiz has been completed, advisors get a summary of their clients’ answers along with suggested talking points, so that they can facilitate a meaningful conversation around their clients’ selected ESG topics.

Let’s talk about ESG Pro’s pilot phase. What was it like to build ESG Pro’s model construction features while simultaneously testing these with clients?

Let’s just say the idea of testing software with clients before you’ve even built it feels like flying a plane while building it too. There were a lot of moving pieces and coordination needed, but it allowed us to start learning on day one.

We used spreadsheets to simulate the process of building and editing ESG model portfolios. All our simulations were based on actual pilot clients’ investments and data to make the experience as real as possible.

How did the team evolve the prototypes into working software?

As soon as we had a functioning data feed, our developers built a rough prototype that mimicked our spreadsheets. We then added on pieces of working software and more comprehensive design. This allowed us to truly focus on delivering a high-value solution for the client rather than what was easiest or cheapest to build.

“Let’s just say the idea of testing software with clients before you’ve even built it feels like flying a plane while building it too… but it allowed us to start learning on day one.” – Carin Stimolo

What did the team learn?

One big “Aha!” was around the ESG data itself. It was helpful for RIAs to see ESG data points, but what they really needed was guidance for interpreting these data points. So, we created percentile rankings and designed data visualization for 24 out of over 200 MSCI ESG data points¹. These data points were selected based on a number of factors, but most importantly client interest, advisor interest, and data quality.

Okay, so RIAs may want ESG Pro to help them make sense of the ESG data. What else?

We learned that it was easier for some RIAs to get started with ready-made ESG Pro Models that they could choose to edit. But we also needed to help RIAs understand why certain funds were selected for our models, and how to evaluate other ESG funds. This led to our agreement to move under Fidelity Institutional Wealth Adviser LLC (“FIWA”), a Fidelity investment adviser which provides access to proprietary research and a vetted list of ESG funds and ETFs to our RIA clients.

Last question: What is most fascinating and unique about your work on ESG Pro?

I love working with such a talented and multidisciplinary group: quants, creatives, developers, product managers, and more. It’s amazing to see how quickly we can respond to client feedback and incorporate a diverse range of perspectives while working towards the same goal.

For institutional use only. Not for distribution to the public as sales material in any form

¹The 24 ESG characteristics for ESG Pro(R) have been selected from over 200 MSCI ESG characteristics and data points based on general data availability, and research conducted with advisors and their end clients.

The content provided in this presentation is general in nature and is for informational purposes only. This information is not individualized and is not intended to serve as the primary or sole basis for your decisions as there may be other factors you should consider. Fidelity InstitutionalSM does not provide financial or investment advice of any kind. You should conduct your own due diligence and analysis based on your specific needs.

Investing based on environmental, social and corporate governance (“ESG”) factors may cause a strategy to forgo certain investment opportunities available to strategies that do not use such criteria. Because of the subjective nature of ESG investing, there can be no guarantee that ESG criteria in ESG Pro® strategies will reflect the beliefs or values of any particular client. Additionally, ESG Pro® must rely upon ESG-related information and data obtained through third-party reporting that may be incomplete or inaccurate, which could result in ESG Pro imprecisely evaluating an issuer’s practices with respect to ESG factors.

© MSCI 2021. All Rights Reserved. Without prior written permission of MSCI, this information and any other MSCI Intellectual property may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an ‘as is’ basis, and the user of this information assumes the entire risk of any use made of this information. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for an direct, indirect, special, punitive, consequential or any other damages (including lost profits) relating to any use of this information.

ESG Pro is an investment advisory service of Fidelity Institutional Wealth Adviser LLC, a registered investment adviser, and an affiliate of FMR LLC.

© 2021 FMR LLC. All rights reserved.

971599.1.0