It is important to note that Strategic Advisers is not actively monitoring sustainable measures of underlying fund holdings. Strategic Advisers generally applies fundamental research processes to identify mutual funds and ETPs that, in its judgement, have meaningfully integrated sustainability practices focused on environmental, social and governance criteria into their investment research and decision-making process.

1. Sustainability ratings used may include proprietary and third-party scores.

2. Representative of the equity portion (60% or $150k) of a Sustainable Personalized Portfolios Blended Growth with Income model portfolio.

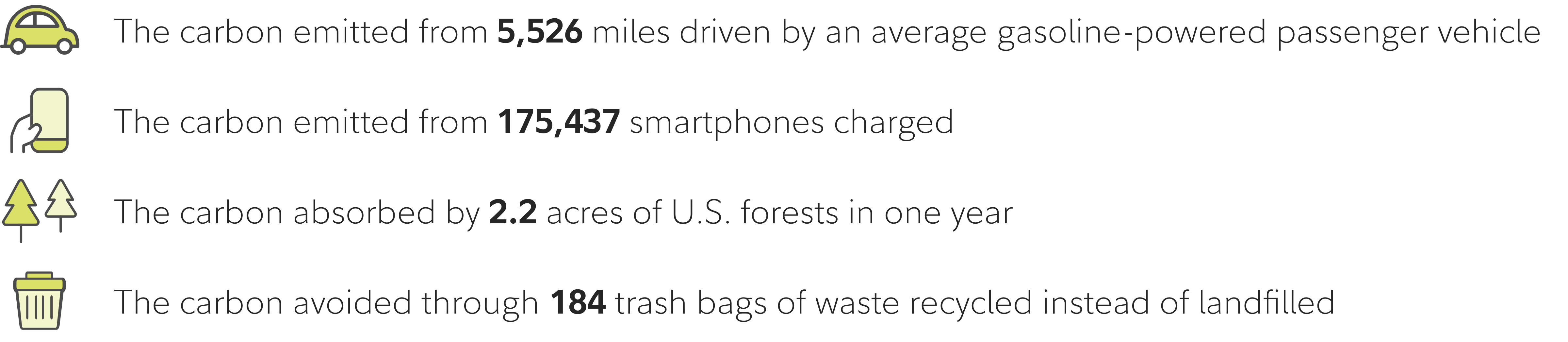

3. This figure was calculated using the carbon emissions intensity (tCO2e/$M EVIC) metric for the Sustainable Personalized Portfolios Blended Growth with Income relative to a blended index as of 12/29/2024. This analysis is limited to at least 95% of the equity portion of the Sustainable Personalized Portfolios Blended Growth with Income portfolio due to data availability and validation. Carbon emissions intensity (tCO2e/$M EVIC) represents the aggregated recently reported or estimated Scope 1 and 2 emissions normalized by the most recently available enterprise value including cash (EVIC) in million USD. This ratio facilitates portfolio analysis by allocating emissions across equity. A lower score means lower exposure to carbon intensive companies.

4. A blended index is used for comparison purposes. It consists of U.S. stocks—Dow Jones U.S. Total Stock Market Index (70%) and International stocks—MSCI All Country World ExUSA Index (Net MA) (30%).

The Dow Jones U.S. Total Stock Market Index is an all-inclusive measure composed of all U.S. equity securities with readily available prices. This broad index is sliced according to stock-size segment, style, and sector to create distinct sub-indexes that track every major segment of the market.

The MSCI All Country World Ex-USA Index (Net MA) is a market capitalization–weighted index designed to measure the investable equity market performance for global investors of large– and mid–cap stocks in developed and emerging markets, excluding the United States.

Indexes are unmanaged. It is not possible to invest directly in an index.

5. Data is compiled by third-party sources that FMRCo, the sustainable universe provider, believes to be reliable, but neither FMRCo nor Strategic Advisers can guarantee the accuracy of any such third-party information. Data is limited by the fact that issuers in the investment universe are not subject to reporting requirements for some of the footprint metrics. If the sustainability universe provider determines any of the issuer data is materially inaccurate and the data is not corrected for any reason, that issuer's data is excluded from the metrics shown. Data is provided for informational purposes only and should not be relied upon by clients when making investment decisions or for any other purpose.

The metrics shown on this page are calculated solely by Fidelity using certain information provided by the United States Environmental Protection Agency (the "Information"). Per the United States Environmental Protection Agency, these estimates are approximate and should not be used for emission inventories or formal carbon emissions analysis. Although Fidelity information providers, including the United Stated Environmental Protection Agency and its affiliates (the "ESG Parties"), obtain information from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy and/or completeness of the Information provided. The ESG Parties do not claim that the Information can or should be used for any particular purpose. None of the Information in and of itself can be used to decide when or whether to invest in a particular product or security. None of the ESG Parties shall have any liability for any errors or unintentional omissions in connection with any Information or with any damages related to the Information or its use.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Sustainable Personalized Portfolios account will hold funds other than Fidelity’s actively managed sustainable funds, and it is important to understand that Fidelity’s sustainable index funds, Fidelity’s traditional funds not focused on sustainable investments, and non-Fidelity funds do not adhere to the sustainable investing exclusion criteria and may have exposure to controversial industries including civilian semi-automatic firearms, coal production and/or mining, controversial weapons, for-profit prisons and/or tobacco production.

While environmental, social and corporate governance (ESG) factors, when deemed financially material, are available to incorporate into Fidelity’s investment process across all Fidelity fund offerings, ESG assessments represent one of many pieces of research available to the portfolio managers and the degree to which it impacts a strategy's holdings may vary strategy by strategy based on the portfolio manager’s discretion. Investing based on ESG factors may cause a strategy to forgo certain investment opportunities available to strategies that do not use such criteria. Because of the subjective nature of sustainable investing, there can be no guarantee that ESG criteria used by Fidelity will reflect the beliefs or values of any particular client.

Environmental, social and corporate governance (ESG) factors are incorporated by Strategic Advisers investment team into their investment process for preferences that have a specific sustainable mandate as clearly disclosed in the product’s offering documents (e.g., Managed Account Fundamentals document, etc.). For preferences that do not have a specific sustainable mandate, Strategic Advisers generally does not consider ESG factors in the investment process though funds with an ESG or sustainable objective are not categorically excluded from these preferences. Investing based on ESG factors may cause a strategy to forgo certain investment opportunities available to strategies that do not use such criteria. Because of the subjective nature of sustainable investing, there can be no guarantee that ESG criteria used by Fidelity will reflect the beliefs or values of any particular client.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Generally, among asset classes stocks are more volatile than bonds or short-term instruments and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Although the bond market is also volatile, lower-quality debt securities including leveraged loans generally offer higher yields compared to investment grade securities, but also involve greater risk of default or price changes. Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market or economic developments, all of which are magnified in emerging markets.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Other than with respect to assets managed on a discretionary basis through an advisory agreement with Strategic Advisers LLC, you are responsible for determining whether, and how, to implement any financial planning recommendations presented, including asset allocation suggestions, and for paying applicable fees. Financial planning does not constitute an offer to sell, a solicitation of any offer to buy, or a recommendation of any security by Fidelity Investments or any third party.

Fidelity® Wealth Services provides non-discretionary financial planning and discretionary investment management through one or more Personalized Portfolios accounts for a fee. Advisory services offered by Strategic Advisers LLC (Strategic Advisers), a registered investment adviser. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. Strategic Advisers, FBS, and NFS are Fidelity Investments companies.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917