Under ideal circumstances, no one would ever run out of money in retirement, and they’d have enough resources to meet all their essential expenses and more. But with the potential for stock market volatility and continuing inflation, more people are searching for predictable income strategies to help meet their retirement needs.

“Now might be the time to consider an annuity even as interest rates come down," says Stefne Lynch, vice president of product management and client engagement at Fidelity. “Fixed annuities allow you to lock in guarantees and security. Some annuities also offer flexibility around things like accessing principal or controlling the timing around taking distributions.”

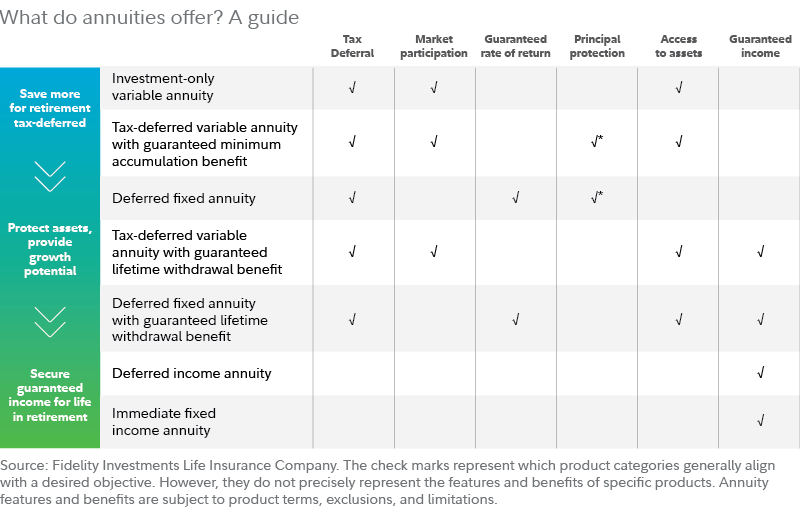

Certain types of annuities can offer a boost to retirement savings, whereas others can offer a dependable income stream for people approaching or already in retirement. In previous years people may have been more circumspect about investing in annuities, due in part to their reputation for complexity and high fees. Today, there’s a wide range of annuities, some of which are less complex and lower in fees and have a range of features that can help you achieve specific financial goals.

“Annuity products have come a long way in recent years, enabling people to better match a specific annuity to their unique needs and preferences,” says Lynch.

To help simplify things, you can think of purchasing an annuity as existing on a life-stage continuum. When you’re saving for retirement, an annuity can offer market exposure, and growth potential that could complement other parts of your portfolio that are invested more conservatively, such as in CDs and bonds. They can also offer tax deferral as you build your nest egg.

As you begin to approach retirement, you may want some market exposure without taking on too much risk. There are annuities that can reduce market volatility risk, or you may even consider starting to purchase annuities that provide an income stream at a date you set in the future.

Lastly, when you retire, the need to cover your essential expenses can be critical. Annuities that provide regular payments can give you (and your spouse) guaranteed income either for life or a set period of time.

Ultimately, annuities can help manage 3 main retirement risks; namely, market volatility, the possibility you could outlive your savings, and the risk inflation will eat away at your savings.

What is an annuity?

At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and onto the company. There are 2 basic types of annuities:

Income annuities can offer a payout for life or a set period of time in return for a lump-sum investment. They can also be a boost to the conservative part of your portfolio by delivering contractually agreed-upon payments in increments that can be monthly, quarterly, or even yearly. In all cases, since an income annuity's guarantees are subject to the claims-paying ability of the issuing insurance company, it is important to do your research and choose an annuity issued by a financially strong insurance company.

Tax-deferred annuities can allow you to accumulate tax-deferred savings while providing the option to create lifetime income in the future. Deferred annuities provide the opportunity to grow savings tax-deferred, which allows earnings to compound over time. Generally speaking, there are 2 ways to access your assets, each with its own tax implications. You can convert your savings into income and spread out the tax burden over the payments. You can also take withdrawals, which are taxed as gains first and then return of principal once gains are depleted.

Important to consider: Some deferred annuities impose surrender charges or other penalties for withdrawals within a certain period of time after purchase.

How tax-deferred annuities can help savers

Deferred annuities can help you grow retirement savings, once you’ve maxed out contributions for the year to qualified plans such as 401(k)s and IRAs, and they aren’t subject to annual IRS contribution limits.1 Similar to retirement plans, any investment growth is tax-deferred and you won’t owe taxes on an annual basis. The best use of tax-deferred annuity assets is that they may be converted to an income annuity upon retirement, potentially resulting in lower taxes on the long-term gains.

You may also take withdrawals from your tax-deferred annuity without converting it to an income annuity, but your gains would be taxed at ordinary income tax rates.

Tax-deferred fixed annuities have a fixed rate of return that is guaranteed for a set period of time by the issuing insurance company. In contrast, with tax-deferred variable annuities, the rate of return—and therefore the value of your investment—will go up or down depending on the underlying stock, bond, and money market investment options that you select, allowing you to benefit from any market growth.

Tax-deferred annuities can also help you use a strategy known as the anchor strategy. This strategy uses investments that offer a fixed return over a set period of time, such as CDs or tax-deferred fixed annuities, to protect a portion of your principal. Your remaining assets are then invested in growth-oriented securities such as stock mutual funds or exchange-traded funds (ETFs). The goal is to protect the principal of the conservative part of your portfolio while still retaining growth potential, which can help investors who are concerned about losing money during periods of market volatility.

Growing your savings prior to retirement

Among the annuities to consider if you are years away from retirement, a tax-deferred variable annuity2 can help you grow your savings on a tax-deferred basis by giving you market exposure. A tax-deferred variable annuity has underlying investment options, typically referred to as subaccounts, that are like mutual funds. There are no IRS annual limits to contributions and you choose how you’d like to allocate money among different investments to potentially benefit from market growth. And you can reallocate assets or trade among subaccounts within the annuity tax-free. Additionally, you don’t pay taxes until you receive an income payment or make a withdrawal, at which point earnings, as well as any pre-tax contributions, are taxed as ordinary income.

Tax-deferred variable annuities are typically invested with nonqualified money, or money that does not already have a special tax treatment such as 401(k) or IRA money. While you can benefit from a tax-deferred variable annuity’s market exposure, you’ll also pay fees for the annuity.

Good to know: For someone already in retirement, a tax-deferred variable annuity funded with after-tax (nonqualified) money can also serve as a wealth transfer device, as some insurance companies allow the tax savings to extend to a non-spousal beneficiary, who can then receive stretch payments over their lifetime.

Learn more about a Fidelity Personal Retirement Annuity.

How annuities can help people nearing retirement

As you head into the 5- to 10-year homestretch before retirement, your financial plan will likely begin to change, especially as you consider shifting from saving to spending your nest egg. You may be looking for stable returns, or you may still be seeking growth potential from your savings.

A tax-deferred fixed annuity (also known as a single premium deferred annuity, or SPDA) may be for someone living in retirement. But if you’re looking for stable returns in the years prior to retirement, a tax-deferred fixed annuity can play a role in the conservative part of your portfolio by providing a fixed rate of return. Such an annuity guarantees a rate of return over a predetermined time, typically 3 to 10 years, similar to a bank CD which can also offer a fixed rate of return for a set period of time. And just like a CD, if you’re not ready to begin drawing income, you can roll those assets into a new contract with a new guaranteed rate of return. (An important difference is that many CDs are FDIC insured, whereas annuities are subject to the claims-paying ability of the issuing insurance company.) When interest rates increase, it tends to drive up the rates offered by deferred fixed annuities and CDs. The opposite is true when interest rates decrease.

It’s important to note that tax-deferred fixed annuities have surrender charges and aren’t intended for people who need access to their assets during the guarantee period. However, tax-deferred fixed annuities can offer some penalty-free liquidity, equivalent to 10% of the contract amount, for unexpected events or to satisfy required minimum distributions from retirement accounts. Taxes are owed on earnings when you start receiving payments.

Similarly, some annuities can guarantee return of your original investment at the end of a minimum holding period while also offering a degree of exposure to the markets. For example, a deferred variable annuity with a guaranteed minimum accumulation benefit (GMAB) can provide market exposure while guaranteeing the return of your initial investment at the end of a defined holding period, which is often 10 years. That’s regardless of market performance, and less the impact of any withdrawals or resetting of the benefit. When you purchase the contract, your principal is fully protected, and your underlying investment has the potential for long-term growth. A GMAB can let you benefit from market gains, but unlike stocks, if the market bottoms out, you get your original principal back in full.3

Keep in mind, however, that the benefit comes with a cost. Investors purchasing a GMAB should be comfortable paying a higher fee in return for the contract's protection.

For people who are just a few years from retirement, a deferred income annuity (DIA)4 can provide guaranteed income and a steady cash flow for life. DIAs should not be confused with a tax-deferred annuity, where taxes are deferred. Instead, DIAs provide a fixed payout—but, as their name implies, the payout is deferred until a predetermined date in the future that you select.

With a DIA, you may also take advantage of periodic investing to secure income payments in varying interest-rate environments. Each investment you make enables you to lock in income that is added to your final cash flow payment when you are ready to start. Similar to dollar-cost averaging, you may potentially benefit from a range of interest rates.

Annuities for people living in retirement

When you’ve reached retirement you may want the security of having a guaranteed source of income that can help cover your essential expenses, and income annuities can offer a pension-like stream of income for life.5 Income annuities may even increase an investor's confidence to enjoy retirement more fully, because they offer dependable income that will last for a lifetime. Retirees will be more confident and comfortable spending money knowing they will always have dependable income in the future.

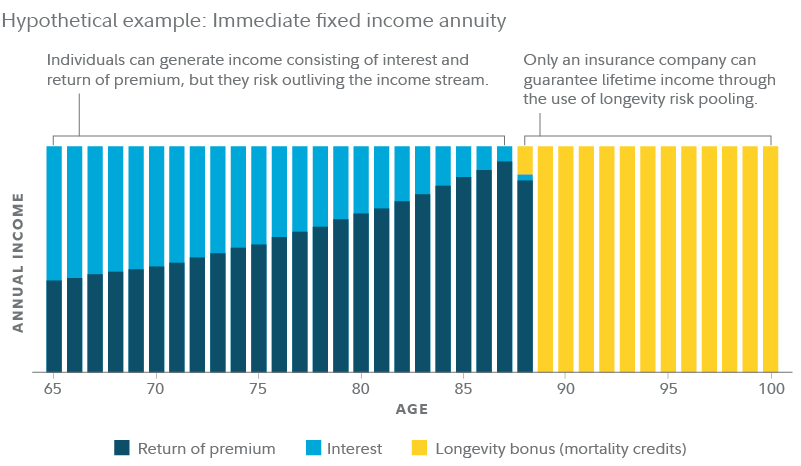

For example, an immediate fixed income annuity, also known as a single premium immediate annuity (SPIA), can provide immediate income in exchange for a lump-sum investment. It can offer a pension-like cash flow, and the guaranteed income isn’t subject to market volatility. Immediate fixed income annuities even have optional features and benefits such as a cost-of-living adjustment (COLA) to help keep pace with inflation and beneficiary protection such as a cash refund.

A cash refund guarantees that upon the passing of the last surviving annuitant, the beneficiaries will be refunded any difference between your original principal and the payments received—eliminating the fear that the insurance companies will keep your money.

Immediate fixed income annuities may give investors the ability to share in the longevity benefits of the mortality pool. That means assets from other annuitants are pooled together by the insurance company, and those who live longer receive payments from those with shorter life spans. In other words, you won’t be in danger of running out of money. Instead, the longer you live, the more money you could receive.

A joint and survivor immediate fixed income annuity may offer a simple, low-maintenance way to sustain a portion of retirement income for a surviving spouse or planning partner—which could be an important benefit in circumstances when the remaining spouse is not comfortable making investment decisions or doesn’t have the capacity to do so.

Good to know: If you purchase an immediate fixed income annuity, you may have limited or no access to the annuity principal.

Find out more about fixed income lifetime annuities in Viewpoints: Create income that can last a lifetime.

Finally, you can consider a guaranteed lifetime withdrawal benefit annuity (GLWB). This is an additional feature, called a rider, on either a tax-deferred fixed or variable annuity (based on the underlying investment within the annuity). An annuity with a GLWB provides guaranteed income for life even if the underlying investment account value (meaning the annuity’s) has been depleted.

The variable GLWB annuity allows you to remain invested in the market, but it guarantees income, and that income can increase based on markets, but it will not decrease.6 The longer you defer your income, the larger your payout could be. In addition, you have access to your account value should your circumstances change (surrender charges may apply and the guaranteed income amount will be reduced).

A GLWB annuity can give you more flexibility when you start taking income, including access to the account if your situation changes. That’s a bit different from a single premium income annuity, where you give up control of your money in exchange for a regular, steady lifetime payout.

Gaining peace of mind when retiring

Nobody knows how long they will live in retirement, so it’s critical to save for the time when you stop working, and to have guaranteed lifetime income to make sure your essential expenses are covered. Annuities can help you cover gaps, and they can play an important role as part of a broader retirement income plan to guarantee you’ll have income that you will never outlive. Make sure to consult with a financial advisor before purchasing an annuity, so they can help you understand the pros and cons of the various types of each annuity available to you. (You shouldn’t pay extra for riders or additional features that you simply don’t need.) And then select an annuity that meets a specific financial need as you plan your future.