Can you get principal protection and potential investment growth? That's what indexed annuities promise but it's important to understand how these products work before buying.

What is an indexed annuity?

An indexed annuity is a contract issued and guaranteed1 by an insurance company. They are not considered securities or regulated by the SEC or FINRA. Instead they are regulated by state insurance departments. You invest an amount of money (premium) in return for growth potential based on the returns of a linked market index (e.g. the S&P 500® Index); protection against negative returns of the same linked market index; and in some cases a guaranteed level of lifetime income through optional riders.

With more and more frequency, conversations about indexed annuities may also include a similar but different type of variable annuity that goes by the name buffer annuity, or RILA (registered index linked annuity). Read more: Buffer annuities: What to know.

How is the potential investment return calculated?

One element of indexed annuities that is often misunderstood is the calculation of the investment return credited to your account. To determine how the insurance company calculates the return, it is important to understand how the index is tracked, as well as how much of the index return is credited to you.

Index tracking. The amount credited to your account depends, in part, on how much the index changes. Insurance companies use various methods to track changes in the index value over a defined time period. It is important to understand how the index is tracked, as it will have a direct impact on the return credited to you.

The amount an insurance company credits to you depends on a variety of factors (any of which can potentially be combined), such as:

- Cap, which is an upper limit put on the return over a certain time period. For example, if the index returned 10% but the annuity had a cap of 3%, your account receives a maximum return of 3%. Many indexed annuities put a cap on the return.

- Participation rate, which is the percentage of the index’s return the insurance company credits to the annuity. For example, if the market went up 8% and the annuity's participation rate was 80%, a 6.4% return (80% of the gain) would be credited. Many indexed annuities that have a participation rate also have a cap, which in this example would limit the credited return to 3% instead of 6.4%.

- Spread/margin/asset fee, which is a percentage fee that may be subtracted from the gain in the index linked to the annuity. For example, if an index gained 6% and the spread fee was 2%, then the gain credited to the annuity would be 4%.

- Bonus, which is a percentage of the first-year premiums received that is added to the contract value. Typically, the bonus amount plus any earnings on the bonus are subject to a vesting schedule that may be longer than the surrender charge period schedule.2, 3 Given the typical vesting schedule, the bonus may be entirely forfeited upon surrender in the first few contract years.

- Riders, which are extra features, such as minimum lifetime guaranteed income, that can be added to the annuity for additional costs, further reducing the return credited to the account.

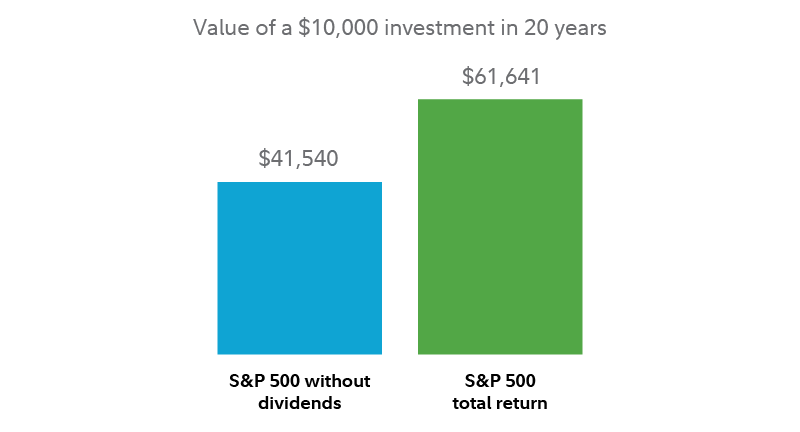

In addition, an often-overlooked point is that for the purposes of the insurance company calculation, an index return excludes dividends, so your return from an indexed annuity will also exclude dividend income. This is important because history indicates that dividends have been a strong component of equity returns over the course of time. For example, over the past 20 years, ending December 2021, the S&P 500 index has gained 7.38% annually without dividends and 9.52% with dividends.

How does a cap impact potential returns?

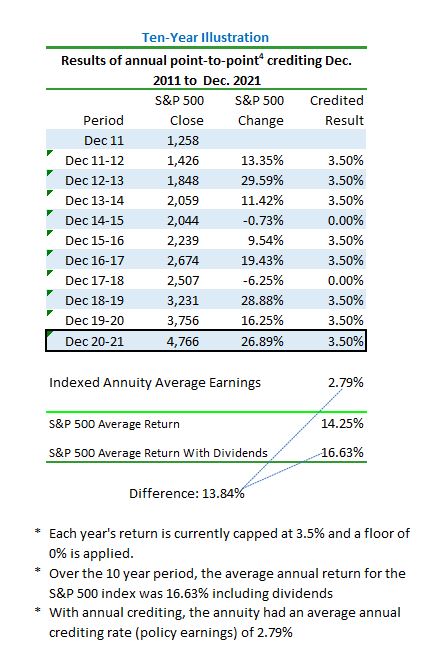

Let's consider the following chart, which uses a hypothetical indexed annuity with an annual cap of 3.5% on upside returns.

Over the 10 years ending December 2021, the S&P 500 average annual return was 16.63% (14.25% without dividends), while the indexed annuity returned only 2.79% annually—despite a guaranteed annual floor of 0%.

Taking a deeper dive, using the 10-year period ending December, 2021 as an example, the representative indexed annuity returned only a small portion of the positive US equity market returns.

"Investors may think they are investing in the market with an indexed annuity, but don't realize the actual return could be muted due to caps and participation rates," says Tim Gannon, a vice president of product management at Fidelity Investments Life Insurance Company.

How much do they cost?

Indexed annuities typically do not have an up-front sales charge, but there are often surrender fees if you need access to your money before the surrender period ends, and other hidden costs.

"Also, indexed annuities have hidden costs that are passed on to customers by the insurance company, by limiting potential returns through a participation rate, cap, or spread," notes Gannon. "That's why it is important to ask your agent to explicitly define how the product works, so you will know up front about any factors that could put a drag on your potential return."

Can you lose money?

The answer, in some cases, is "yes." If the market index linked to your annuity goes down and you receive no or minimal index-linked return, you could lose money on your initial investment if you withdraw assets before the surrender period is up.

"Your principal is protected if you hold the annuity through the surrender period, which could be 10 years or longer," says Tom Ewanich, a vice president and actuary at Fidelity Investments Life Insurance Company. "That’s why it is so important to have a plan and stick with it."

Does it fit your needs?

"No two indexed annuities may be alike, so be sure to do your homework to fully understand how they work in up and down markets," advises Gannon. Depending on what you are looking to address, it may be in your best interest to consider a different type of annuity or a combination of investment products.

For example, for principal protection and market participation, you may benefit from a strategy that invests a portion of your assets in a conservative investment, such as bonds, and the remaining portion of your assets in the stock market, for upside potential.5

For more information on strategies for protecting savings, read this Viewpoints article "Protecting yourself from fear of loss."

"A financial representative can help you build a comprehensive plan that takes into account your specific needs and objectives," says Gannon.