The Fidelity Account®

This full-featured, low-cost brokerage account can meet your needs as you grow as an investor.

Reasons to consider The Fidelity Account

| Investment choices |

Stocks: domestic and international ETFs available to buy commission-free online, including 28 from Fidelity, 329 from iShares®, and 146 from additional industry leaders Options: equity, ETF, and index; includes weekly expirations Mutual Funds: 3,700+ no transaction fee/load funds from Fidelity and other companies Bonds and CDs: 30,000+ investment-grade bonds and other fixed income securities Precious metals: gold, silver, platinum, and palladium |

|---|---|

| Account features |

Margin borrowing for leverage and short-selling strategies International investing in 25 markets and 16 currencies Extended-hours trading, before and after market hours Cash management tools and services for quicker access to your money |

| Comprehensive tools |

Powerful trading website puts you in control. Mobile trading applications help you keep up with the market and your portfolio. Advanced tools for Active Traders provide streaming market data and enhanced trading capability. |

|---|---|

| Research and monitoring |

Free, independent research1 from 20+ providers helps you uncover opportunities, generate ideas, and analyze trends. A single, accuracy-weighted score helps evaluate your stock picks. Customized alerts and watch lists carry across platforms—online and mobile. |

| Fidelity service advantage |

24/7 access to experienced investment/trading consultants Over 150 Investor Centers |

| Annual account fee | None |

|---|---|

| Commissions and fees |

$0 commission for online US stock, ETF, and option trades |

| Margin rates |

Competitive rates as low as 9.25%2 |

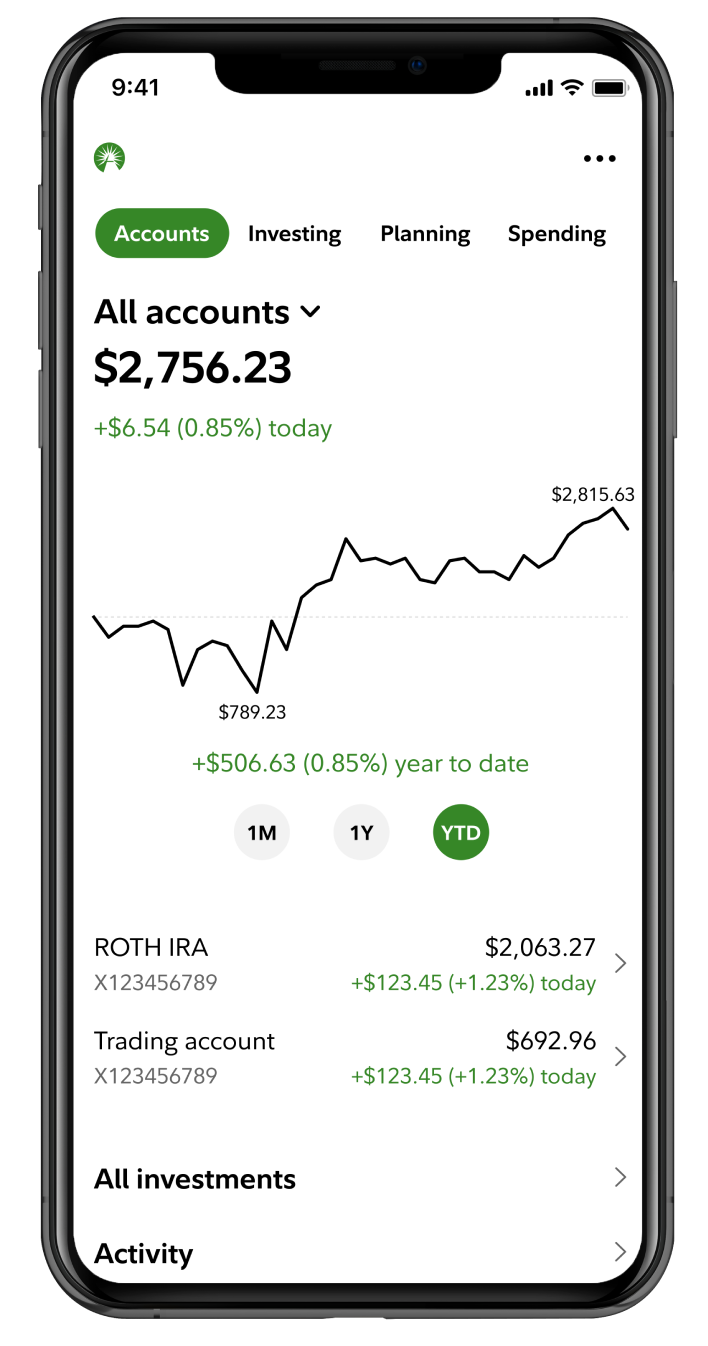

Stay connected to every aspect of the financial world and trade anytime, anywhere. Manage your portfolio and watch lists; research; and trade stocks, ETFs, options, and more from our mobile app.

Download the Fidelity Mobile® app now

Download the Fidelity Mobile® app now

Fidelity® Basket Portfolios

Not your everyday basket investing

A faster and easier way to build a basket of stocks and ETFs and manage it as one investment. More possibilities. More control.