Introducing tax-smart investing

We understand that you may have questions about the new tax-smart investing techniques1 that we'll use in managing your account, the assumptions we're making about your tax profile, and what these enhancements mean for your account going forward.

Questions?

800-544-3455

Why are we doing this?

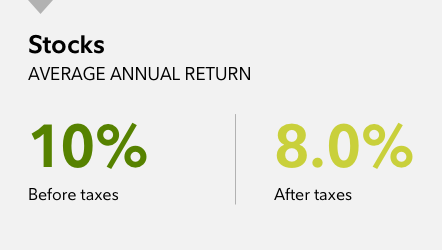

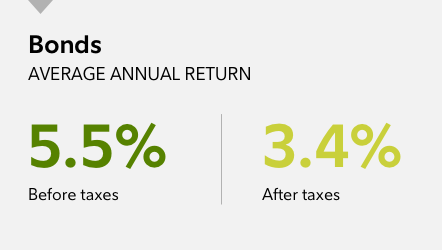

As the table below shows, taxes have historically had a significant impact on returns for both stock and bond investors. While we can't fully eliminate the impact of taxes on your returns, these new techniques in your managed account are designed to help you keep more of what your investments earn.

Taxes Significantly Reduce Returns* (1926-2018)

The impact of taxes is even more significant when viewed over a multi-year cumulative period.

*Past performance is no guarantee of future results. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. Stocks are represented by the Ibbotson® Large Company Stock Index. Bonds are represented by the 20-year U.S. government bond. An investment cannot be made directly in an index. The data assumes reinvestment of income and does not account for transaction costs. Returns data provided by Morningstar, Inc., 2/25/2019. Federal income tax is calculated using the historical marginal and capital gains tax rates for a single taxpayer earning $120,000 in 2015 dollars every year. This annual income is adjusted using the Consumer Price Index in order to obtain the corresponding income level for each year. Income is taxed at the appropriate federal income tax rate as it occurs. When realized, capital gains are calculated assuming the appropriate capital gains rates. The holding period for capital gains tax calculation is assumed to be five years for stocks, while government bonds are held until replaced in the index. No state income taxes are included. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Generally, among asset classes, stocks are more volatile than bonds or short-term instruments. Government bonds and corporate bonds have more moderate short-term price fluctuations than stocks, but provide lower potential long-term returns. U.S. Treasury bills maintain a stable value if held to maturity, but returns are generally only slightly above the inflation rate. Although bonds generally present less short-term risk and volatility than stocks, bonds do entail interest rate risk (as interest rates rise, bond prices usually fall, and vice versa), issuer credit risk, and the risk of default, or the risk that an issuer will be unable to make income or principal payments. The effect of interest rate changes is usually more pronounced for longer-term securities. Additionally, bonds and short-term investments entail greater inflation risk, or the risk that the return of an investment will not keep up with increases in the prices of goods and services, than stocks.

© 2019 Morningstar, Inc. All rights reserved. 2/25/2019.

Make sure your tax profile is up to date

We'll be making investment decisions for your account based on your current tax profile. If you believe changes are necessary, please contact us. Otherwise, we can go over this during your next strategic review.