The value of the US dollar has risen sharply in the second half of 2023, compared to currencies of many other countries including the British pound, the Japanese yen, and the euro.

A stronger dollar sounds like a good thing, like seeing results from all those hours you've spent in the gym. However, currency markets are not weightlifting and being strong is not without negative consequences if you're the dollar. In fact, it may be possible for the dollar to become too strong for its own good.

Why do currencies rise and fall?

To understand why the dollar's strength may not be an unquestionably good thing, it helps to understand how currencies are valued. The amount of a country's currency that can be bought with a specific amount of another country's currency is always in flux. Even countries with close economic and geographic ties such as Canada and the US can see wide swings over time in how much a US dollar buys in Banff or what a Canadian dollar is worth in Key West. Those fluctuating currency values reflect how much the governments, companies, banks, and individual investors who buy and sell in global currency markets are willing to pay. Their views on the relative values of currencies mostly reflect where they believe they will get the best return on their investment.

Typically, if a country has relatively strong economic growth and low debt, its currency will be sought after in global markets which will cause its price to rise. On the other hand, countries whose growth is weak and debt is high may see less demand for their currencies and their value will lag those of countries with more robust economies.

Of course, growth alone doesn't make a currency strong. Emerging-market countries such as Brazil or India may have good long-term growth prospects but their currencies are not so highly valued by global investors. That's because their economies rely heavily on a few industries or commodity exports, which leaves them more susceptible to boom and bust cycles than countries with more diversified economies such as the US, Japan, or Germany.

Why is the dollar strong?

Many investors see the dollar as the safest asset to hold when stock and bond markets turn volatile. That's partly because the dollar has a unique status as the world's "reserve currency." This means central banks and financial institutions around the world hold lots of dollars to use for international transactions. They do this because using a single currency rather than having to convert between currencies helps enable international investing and lending.

The dollar has also gained strength because the US economy looks healthier than those of many other countries where growth is slower and debt and inflation higher than in the US. According to Fidelity's Asset Allocation Research Team, the US economy is currently still growing, while the UK has entered a recession and much of Europe is nearly there as well.

Is a strong dollar bad?

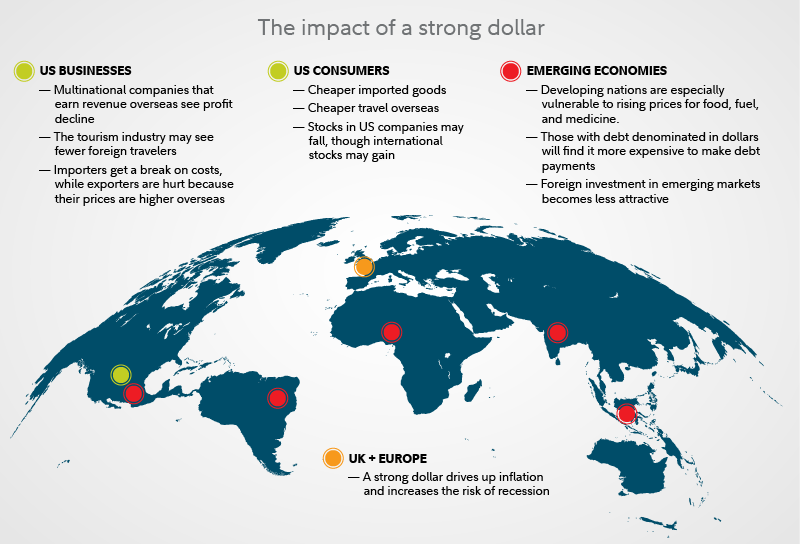

The most obvious risk a strong dollar poses is the way it can hurt the US stocks that many people rely on as mainstays of their retirement accounts. The US-based companies that make up the S&P 500 earn nearly 40% of their revenues outside the US. When the dollar rises against, for example, the euro, then a company's euro-denominated sales are worth less once they're exchanged into dollars. That means a rising dollar is likely to have a noticeable impact on these companies' revenues, earnings, and stock prices.

Besides hurting earnings, a super-strong dollar can also hurt prices of US stocks and bonds by making them more expensive for big non-US institutional investors. Faced with higher prices, they may opt to invest their money elsewhere, dragging US markets downward in the process.

Or is a strong dollar good?

While a strong dollar may hurt US stocks, it also makes international stocks a bargain for US investors who want to diversify their portfolios. Historically, international stocks have outperformed US stocks and they also have tended not to rise or fall in lockstep with US markets. Over time, diversifying with non-US stocks may reduce risk in an investor's portfolio. The strong dollar may also help the stocks of non-US companies who operate in currencies such as the yen or euro but who export their products to the US.

However, making major changes to your investments based on fluctuations in foreign exchange rates may not be a winning strategy because the strength of the dollar hasn't historically been much of a predictor of how stock sectors will perform.

A strong dollar makes imported goods cheaper for US consumers. That may help cushion some of the impact of high inflation in the US, but much of the food and energy whose price increases are hitting households the hardest are produced in the US rather than imported, and continuing supply chain tangles are still likely to influence the prices of foreign-made goods at least as much currency values are.

Cheaper imports also create other problems for the US by increasing the country's trade deficit. The US already imports nearly $1 trillion more in goods and services than it exports each year, almost 5% of the country's gross domestic product (GDP), at a time when total US debt is already well over 100% of GDP. Fidelity's Asset Allocation Research Team says that high levels of public and private debt are likely to mean returns from stock and bond investments may be lower in the decades ahead than they have been historically.

How long will the dollar stay strong?

Kana Norimoto, fixed-income macro analyst at Fidelity, expects the dollar to remain strong as long as the US economy continues to outperform other big economies and the Federal Reserve continues to raise interest rates. She says that the Fed is more concerned with raising rates to fight inflation in the US than it is with how higher rates may affect the value of the dollar.

Perhaps the only clear winners if the dollar stays stronger for longer may be those fortunate enough to be planning trips abroad. Whether it's an overnight in Niagara or a safari in Namibia, you're nearly certain to get more for less.